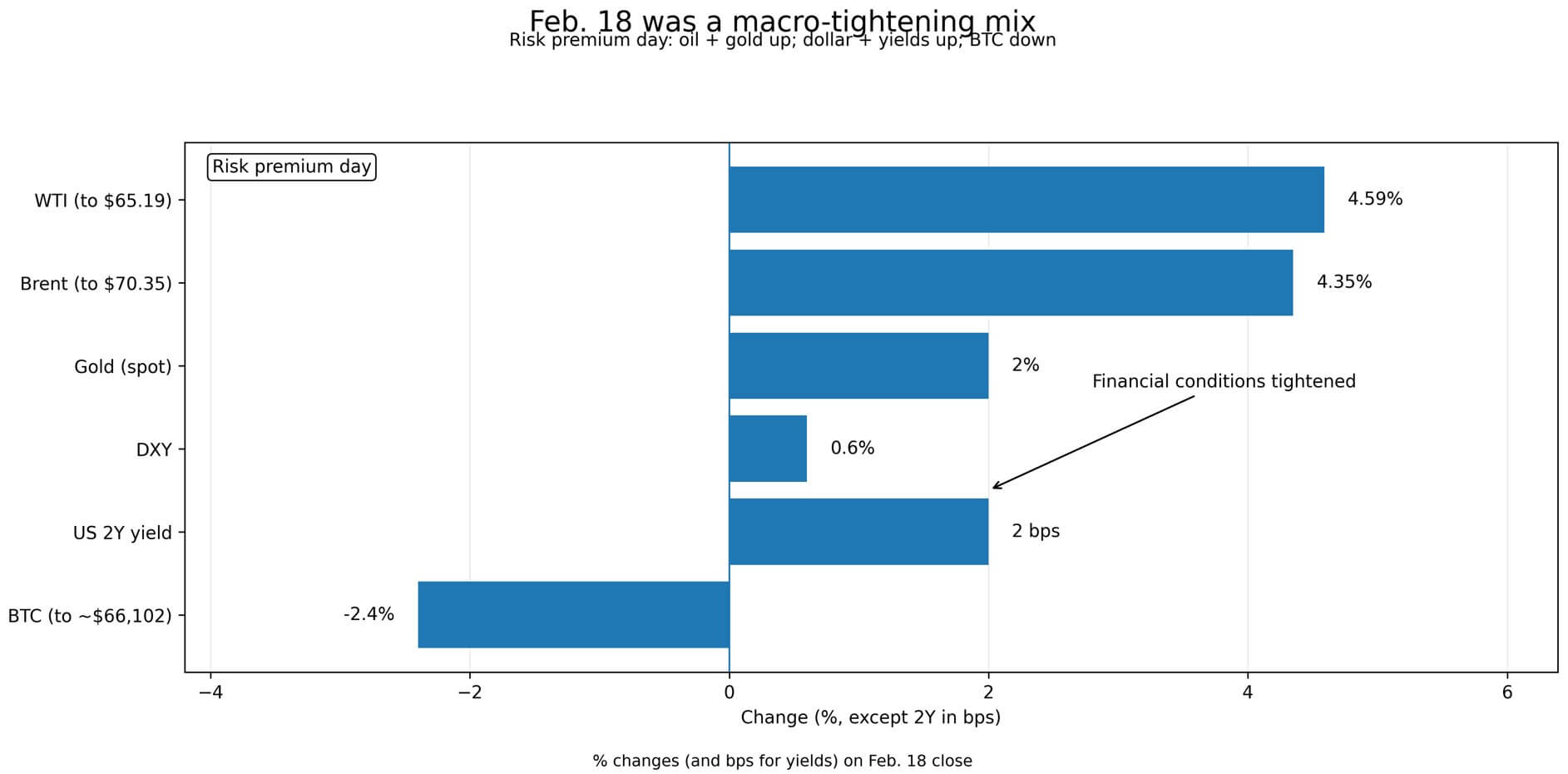

Bitcoin faces a new selloff if oil holds $70 after spike and the Fed turns less patient

Oil isn't supposed to be the story in 2026. The macro narrative powering “cuts soon, liquidity soon” trades relies on disinflation staying intact. However, Brent jumped 4.35% to $70.35 on Feb. 18, and WTI surged 4.59% to $65.19 after headlines revived

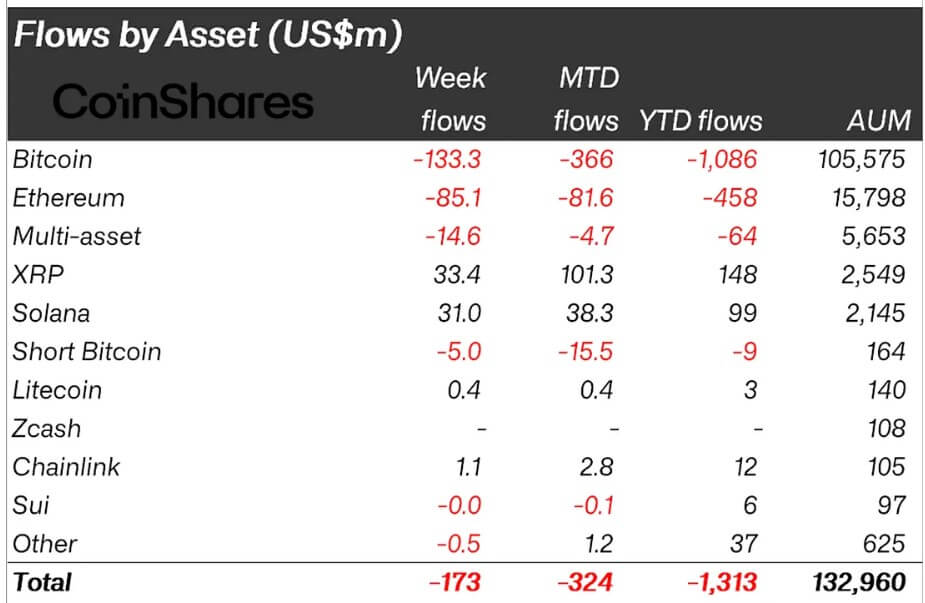

XRP sentiment hits a 5-week high as money rotates away from Bitcoin and Ethereum

XRP is attracting institutional money and a burst of bullish positioning, even as much of the crypto industry remains stuck in a risk-off tape. According to a CoinShares report, XRP is the best-performing crypto token this year, attracting around $150 million in fresh

Bitcoin eyes new liquidity as the Fed’s $18.5 billion repo spike reignites money printer chatter

Bitcoin, the largest cryptocurrency by market capitalization, continued its price struggles as traders weighed two stress-tinged signals from the US financial ecosystem. This week, there was a sudden $18.5 billion Federal Reserve overnight repo operation, and Blue Owl Capital has decided

Is China using US Bitcoin ETFs as a backdoor? Mystery Hong Kong firm invested $436M in BlackRock’s IBIT

An obscure Hong Kong firm has disclosed a $436 million position in BlackRock’s Bitcoin ETF, a revelation that is fueling speculation about Chinese capital flowing into crypto through offshore side doors. Laurore Ltd, a previously unknown entity, reported the stake in

The metrics that matter for XRP network health and how to read them without counting noise

XRP network health scorecard: wallets, trustlines, DEX volume, uptime Key takeaways Ripple and Aviva Investors said Feb. 11 they intend to tokenize traditional fund structures onto the XRP Ledger “over 2026 and beyond.” Messari’s State of XRP Ledger Q4 2025 reported 425,400 total

Bitcoin whales added 200,000 BTC in a month — but short-term demand is fading at the same time

Bitcoin's ongoing price struggles is turning into a market defined less by “bad news” and more by mechanics, the kind that can keep a downtrend alive even when selling looks tired. According to CryptoSlate's data, the BTC price is down approximately

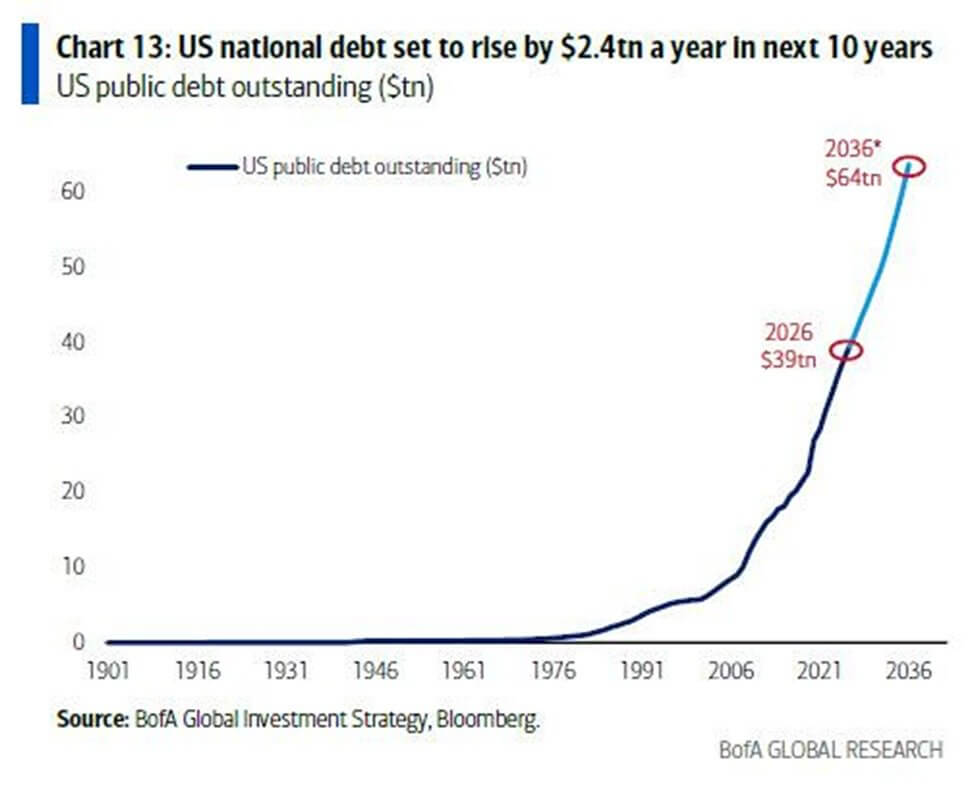

US debt will match WWII-era extreme at $64 trillion within a decade – how does Bitcoin benefit?

The fiscal mathematics of the United States are drifting toward a threshold that markets can no longer afford to ignore, and a level that, relative to GDP, hasn't transpired since the last world war. Washington’s latest budgetary outlook suggests the nation

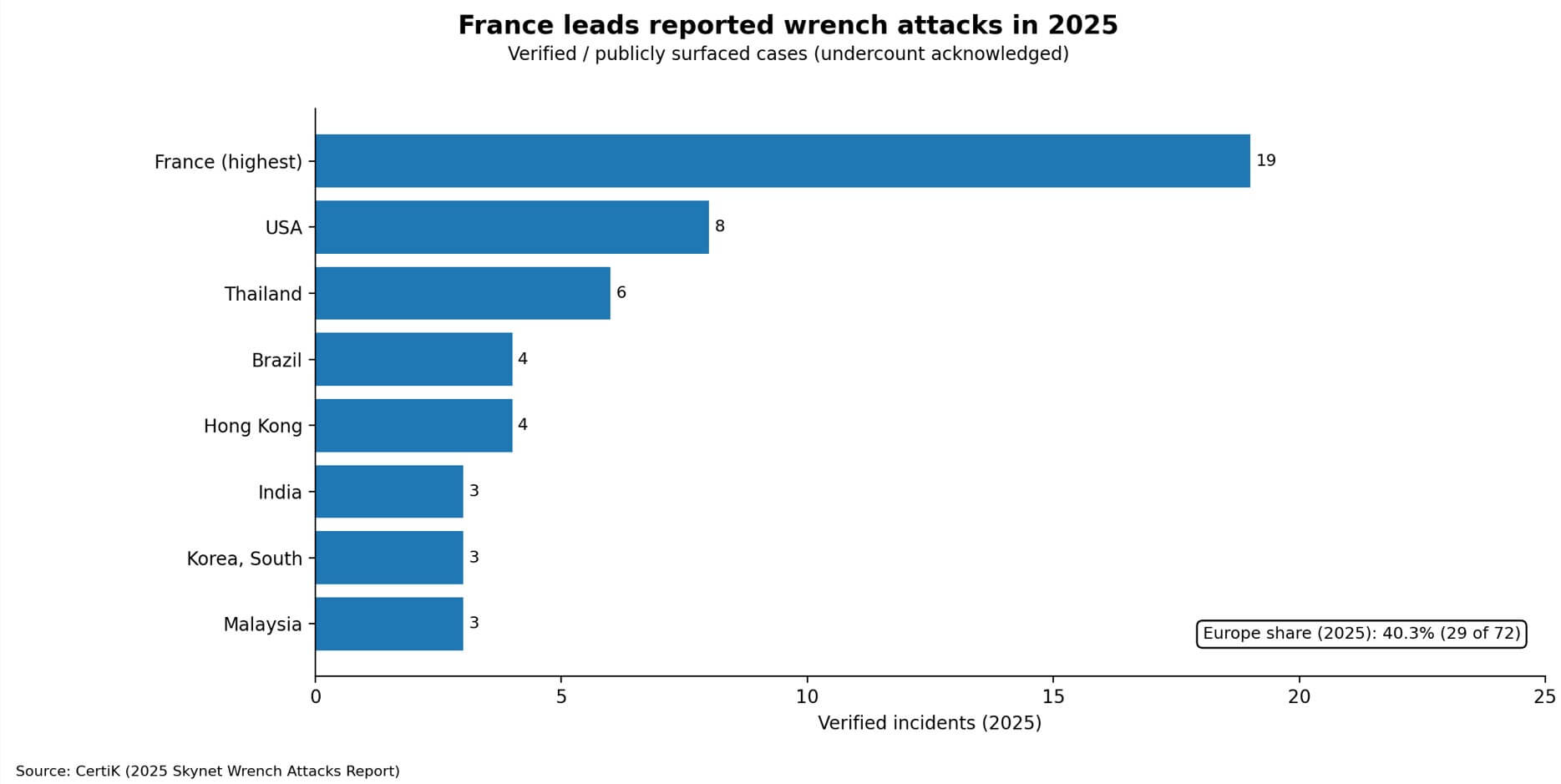

Binance employee hunted down in botched France home invasion as crypto “wrench attack” spike spreads

A botched home invasion in the Paris suburbs on Feb. 12 marked a tactical shift in crypto's physical-threat or “wrench attack” landscape. The target, according to French media reports, was the CEO of Binance France. Binance confirmed an employee was targeted

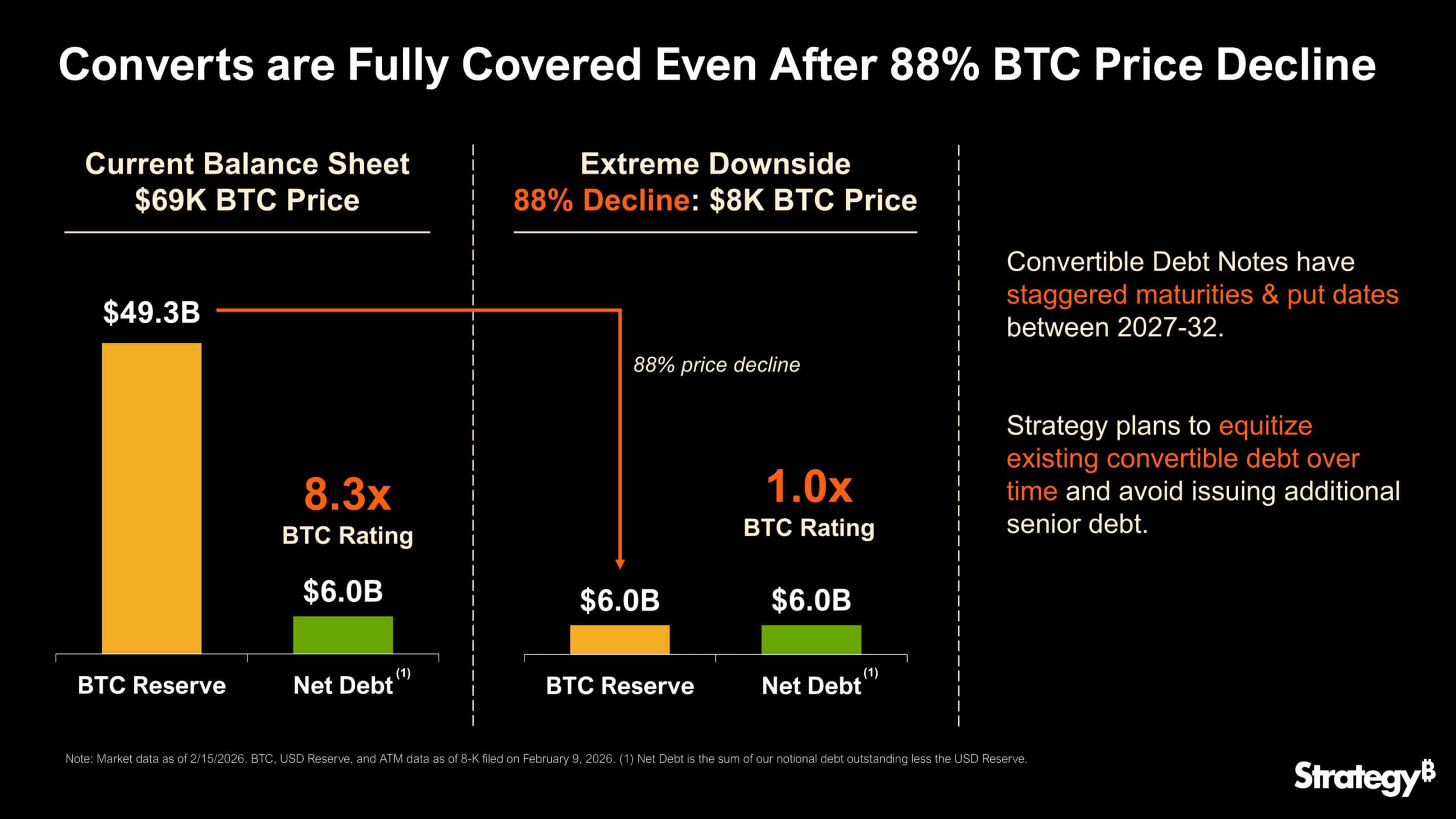

Strategy can survive Bitcoin crashing to $8,000 – but can it escape the slow bleed of dilution?

Strategy (formerly MicroStrategy) has become the public market’s most widely traded Bitcoin proxy, using equity, convertible notes, and preferred stock to build a balance sheet dominated by the top crypto. However, as Bitcoin trades near $68,000 and Strategy shares hover below

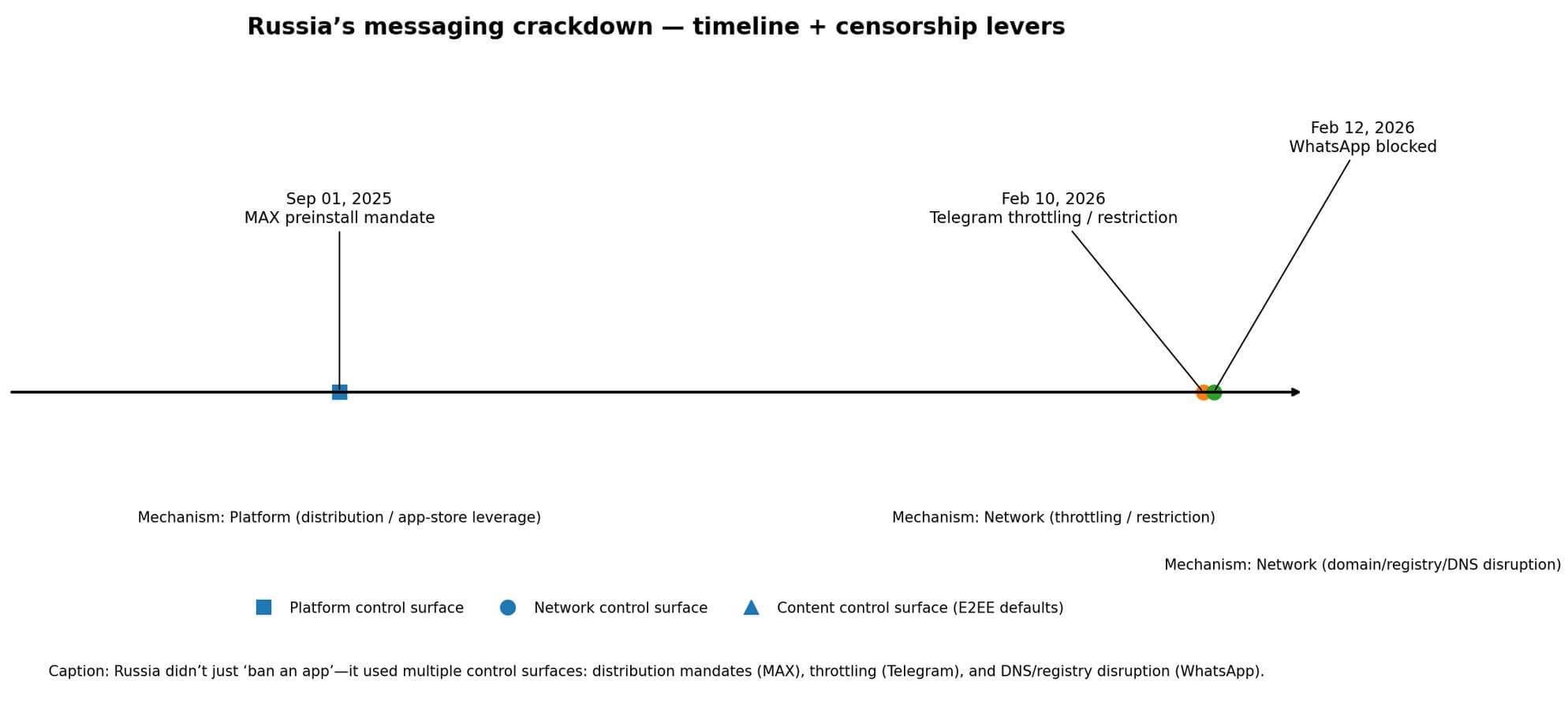

Russia’s censorship crackdown and WhatsApp ban expose the decentralization gap the crypto industry keeps missing

Russia’s recent messaging crackdown is the cleanest real-world stress test of decentralization in years, and it produced an awkward result. Roskomnadzor began throttling Telegram on Feb. 10, citing “non-compliance.” Two days later, authorities fully blocked WhatsApp, removing its domains from Russia's

EU crypto reporting goes live and Netherlands immediately votes on 36% Bitcoin tax – even if you don’t sell

The scoop: The Netherlands has just moved to tax Bitcoin like a stock, marked to market. Lawmakers in the Dutch House backed a Box 3 overhaul that would tax “actual returns,” including annual price changes in liquid assets like BTC, at

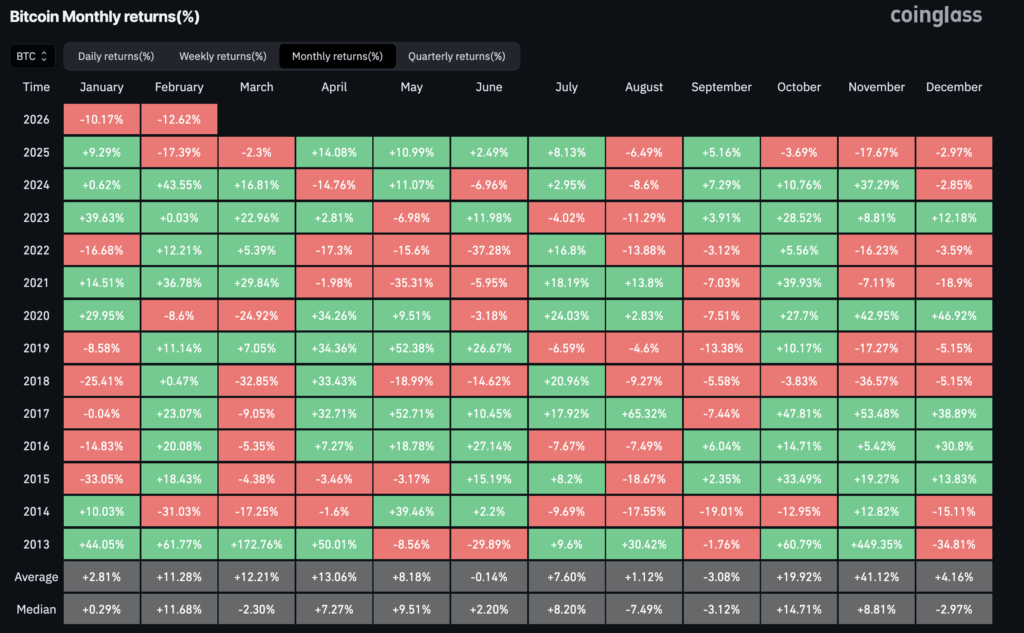

Bitcoin on track to equal its most bearish period in history – only one price matters now

The scoop: Bitcoin is on pace for a fifth straight monthly drop if February closes red, its longest losing streak since 2018, while spot ETF flows flip persistently negative, reinforcing a new reality: post-ETF BTC is trading like a rates-and-risk

Bitcoin no longer acting like “digital gold” because its correlation with physical gold, USD collapsed

In 2025 and early 2026, Bitcoin's behavior has been less “digital gold” and more regime-dependent. Sometimes it trades like a tech beta, then like a rates-and-liquidity-duration trade, and only intermittently like a hedge. The real story is which macro regime makes

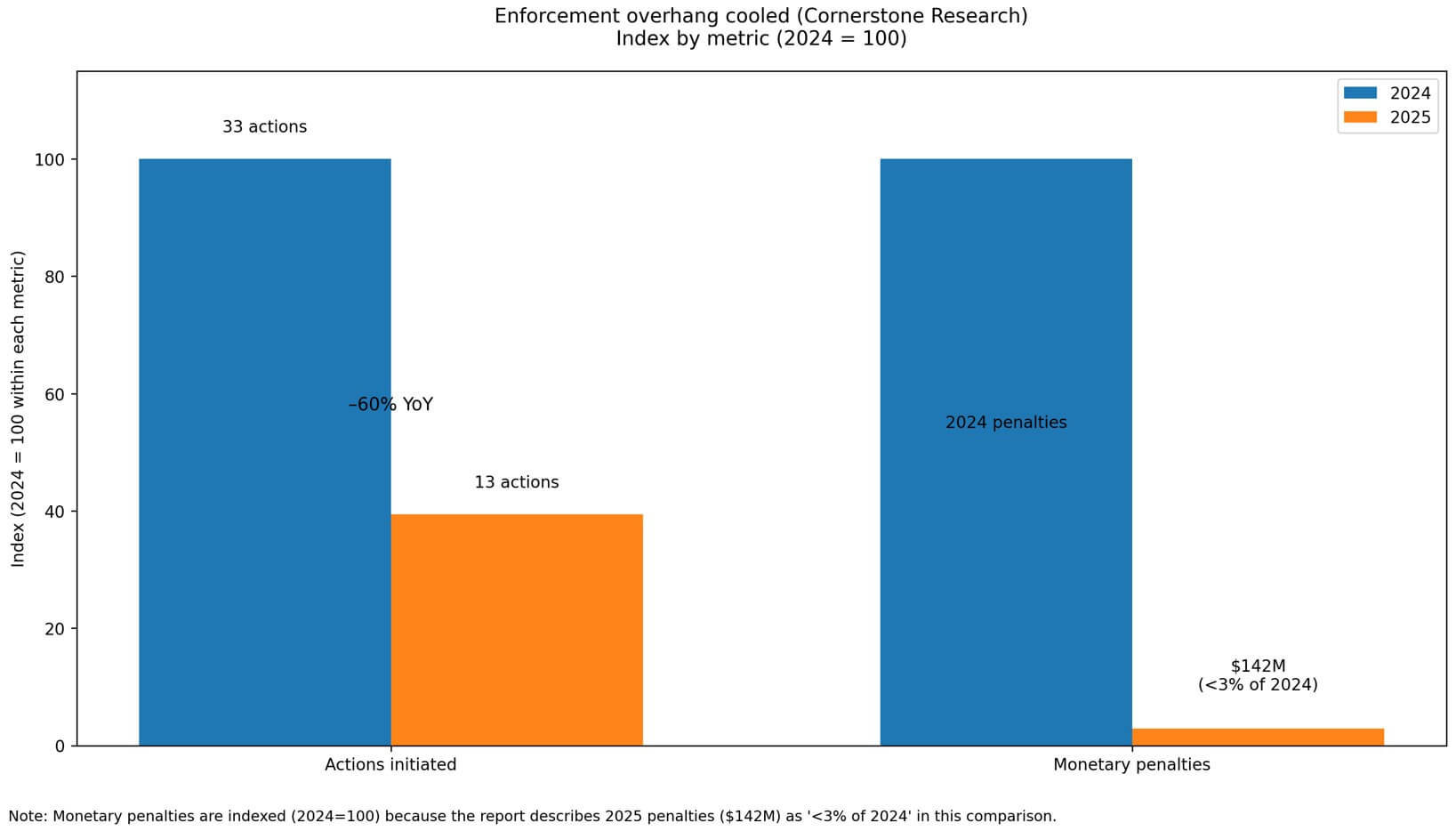

If the SEC stays softer, Aave’s DAO could start capturing $100M+ annualized revenue

Aave Labs posted a governance proposal on Feb. 12 asking tokenholders to endorse a strategic package that would direct 100% of Aave-branded product revenue to the DAO treasury, formalize brand protection, and center the roadmap on Aave V4. The initiative was

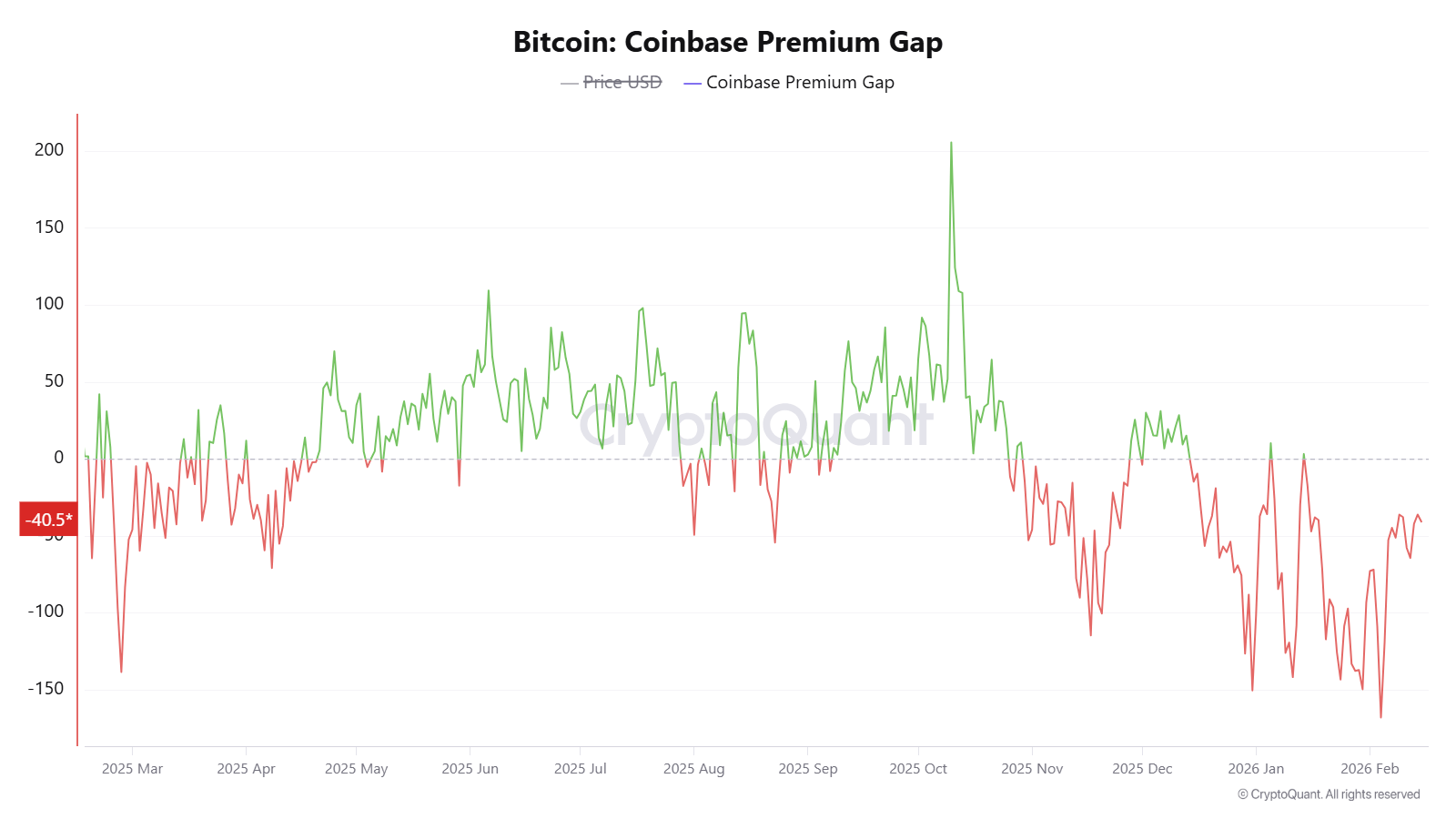

Coinbase diamond hands vs Binance panic sellers — the $60,000 stress test

Bitcoin's recent price crash towards $60,000 did more than just shave billions off market capitalizations or liquidate leveraged positions. It served as a massive, chaotic stress test that exposed a widening behavioral fracture between the two most dominant venues in the

Bitcoin shorts just hit their most extreme level in years as BTC defiantly holds above $70k

Bitcoin derivative traders are increasingly positioning for further downside rather than a clean bounce as the leading cryptocurrency continues to trade in a tight range below $70,000. According to CryptoSlate's data, BTC price bottomed at $65,092 during the last 24 hours

Robinhood’s $221 million crypto revenue drop shows crypto winter isn’t on chain and retail already moved

Crypto winter has a branding problem. The phrase makes it sound like the chain goes quiet, wallets stop moving, and the whole machine turns cold. However, the cleanest proof of retail pulling back rarely lives on-chain. The people who vanish first aren’t

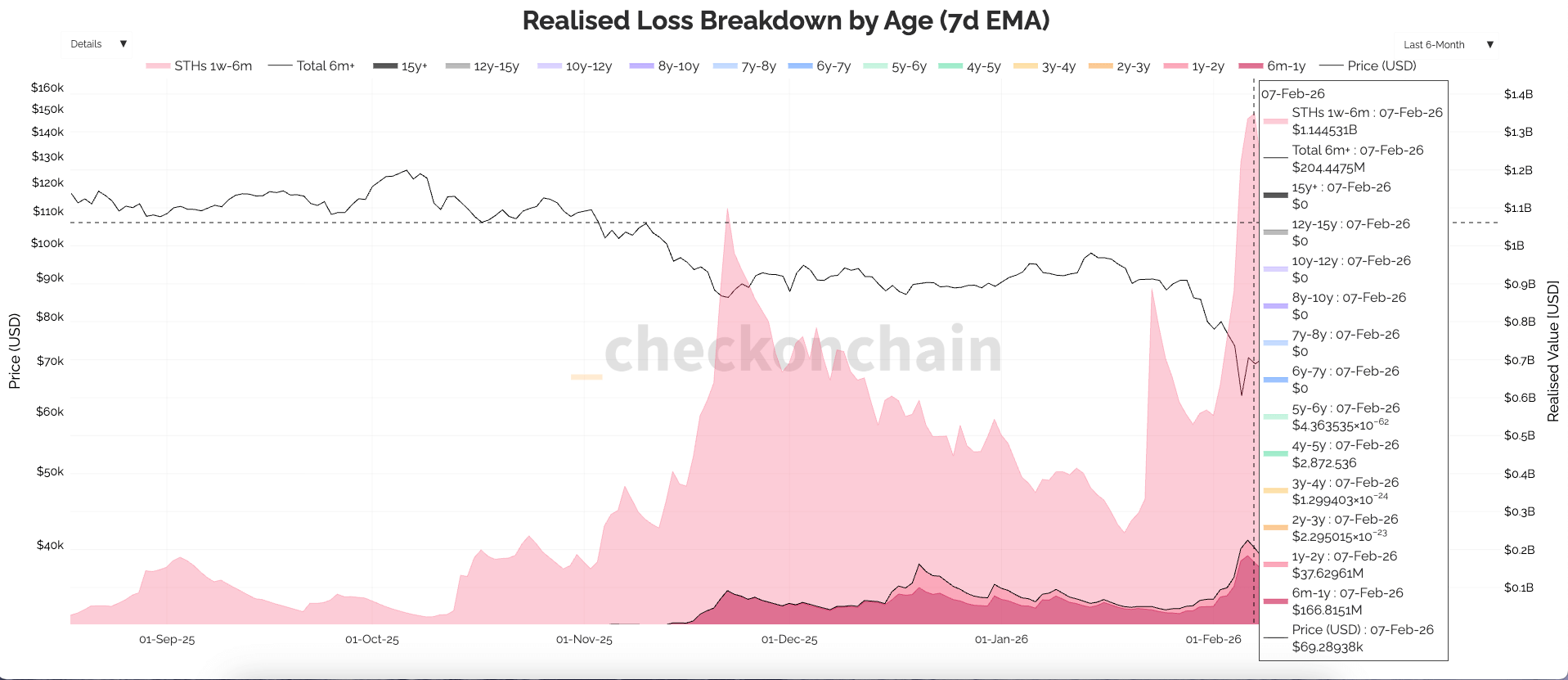

Bitcoin hit $60,000 because two different groups finally surrendered — on-chain data shows who blinked

Bitcoin’s February drop to about $60,000 was the kind of single-day panic people will remember as a bottom. But the more accurate reading of this washout is harder and more useful: this cycle quit in stages, and the sellers rotated. A Feb.