Markets plunge as Bitcoin and silver just triggered a global margin call after inflation warnings made a recovery look impossible

Bitcoin is plummeting toward a dangerous $56,100 price floor as massive ETF outflows signal a demand crisis At some point every cycle has the same moment, the one where the story stops being about charts and starts being about cash. You can

XRP defiant amid Bitcoin collapse as a massive institutional migration quietly shifts billions into Ripple

Bitcoin, Ethereum, and XRP have all retreated to deep cycle lows, dragging the broader crypto market back to valuation levels not seen since late 2024, according to CryptoSlate's data. While price action across the board appears uniformly grim, with BTC heading

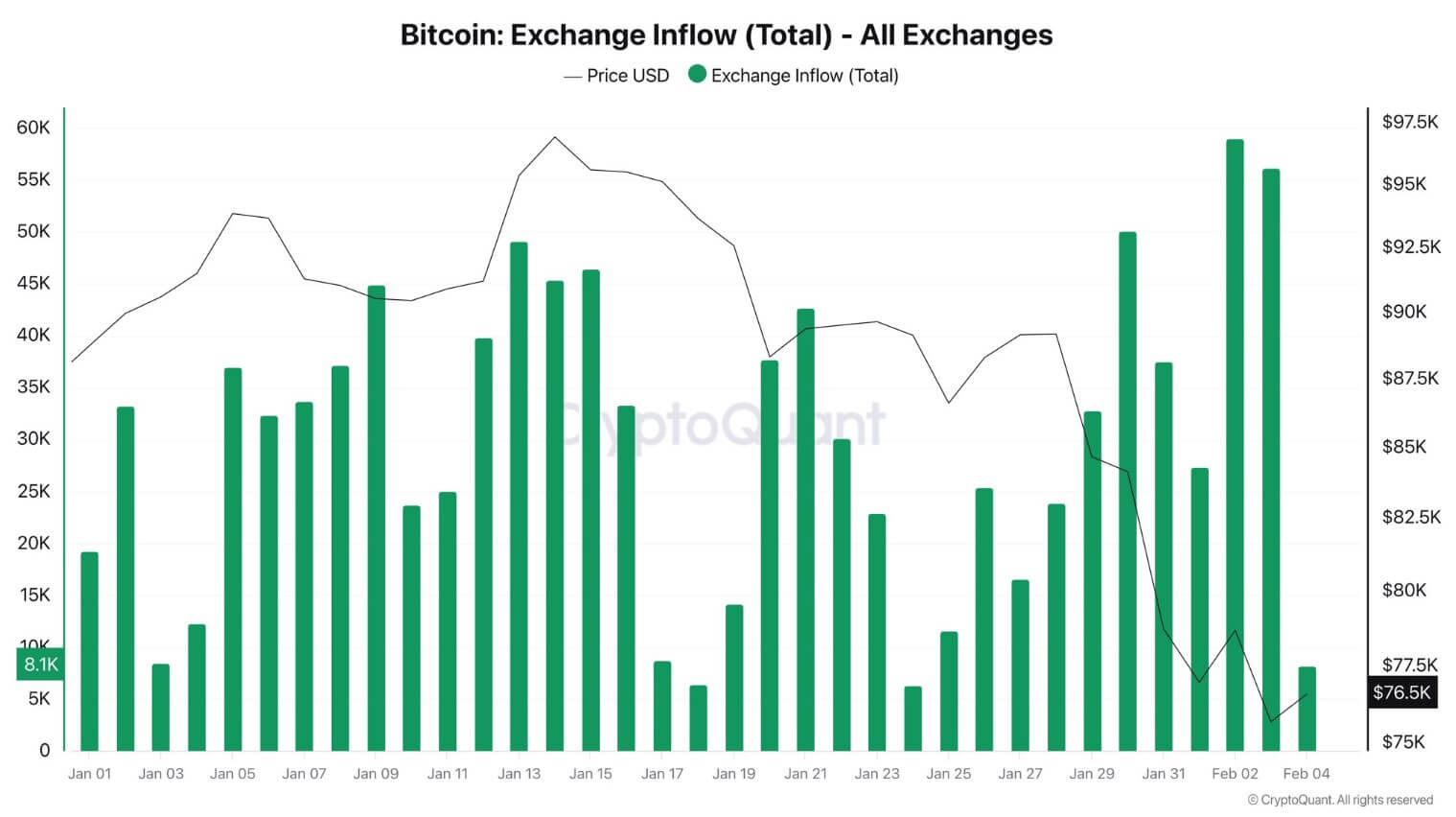

Traders dump $4.3 billion BTC on Binance as exchange sells more Bitcoin than other exchanges combined

Binance moved 42.8% of total spot volume over the past week but absorbed 79.7% of net selling pressure across five major exchanges, according to data from Traderview. The imbalance raises the question of whether a venue needs to handle “most of

Ethereum fees are plummeting so fast that Vitalik Buterin says most Layer 2 chains now lack purpose

Ethereum was cheaper than expected in 2020, and rollup decentralization was slower than promised in 2021. Those two realities are forced the ecosystem to rewrite what “a layer-2” is for. Vitalik Buterin's recent post on Ethereum Research bluntly frames the shift:

Hyperliquid flips the bear market script with a 71% surge while trillions vanish from global risk trades

Hyperliquid has broken ranks with the broader digital asset market, posting a massive double-digit rally while Bitcoin and other major altcoins like XRP suffer from the bear market. According to CryptoSlate's data, Hyperliquid's HYPE is one of the crypto market's top

White House sets February deadline to settle $6.6 trillion fight between Coinbase and banks

The White House's end-of-February deadline for banks and crypto firms to resolve the “stablecoin yield” debate exposes a structural fault line that was never going to stay buried. This isn't a speed bump on the road to crypto-friendly regulation. Instead, it's

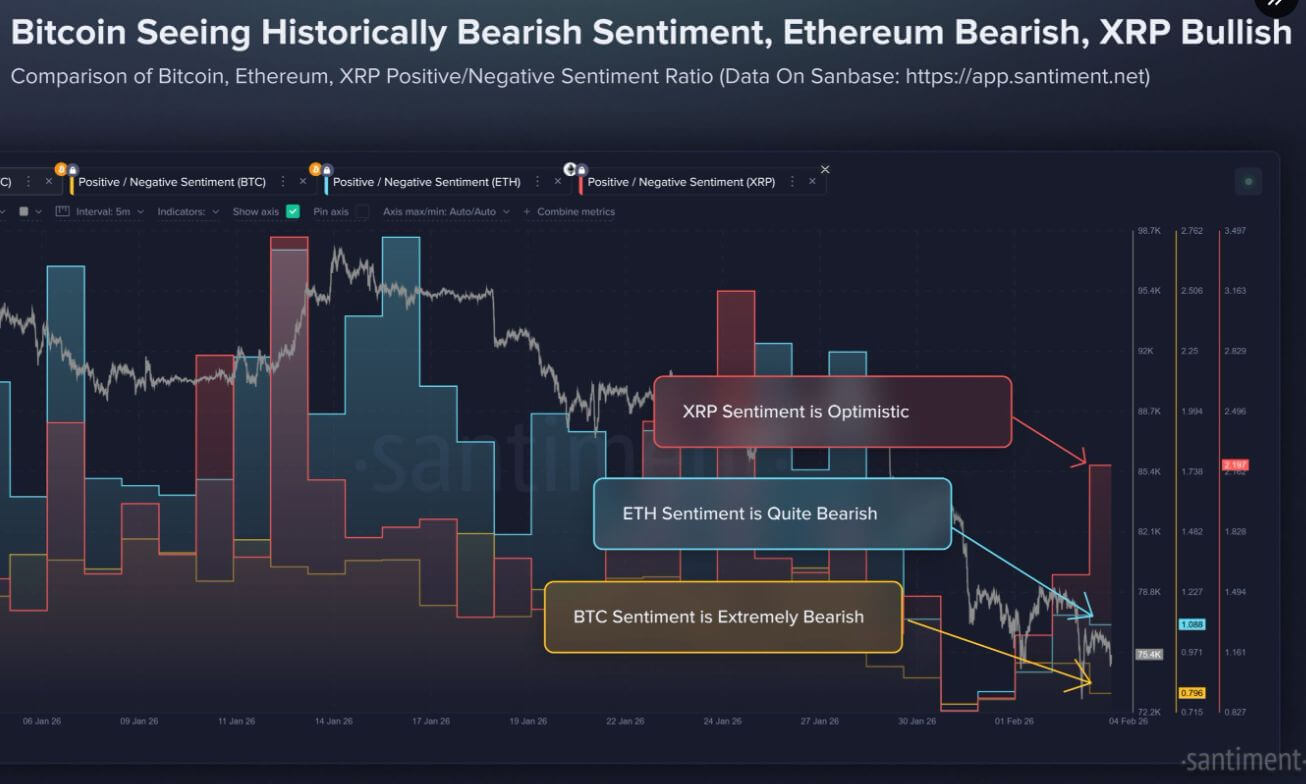

Bitcoin bear market ends when 3 signals flip, and one is already starting to twitch

Julio Moreno, head of research at CryptoQuant, recently declared that Bitcoin is in a bear market that could extend through the third quarter of 2026. He's not alone. Matt Hougan at Bitwise and a growing chorus of institutional voices are using

Vitalik Buterin takes shot at Coinbase’s corporate control of Base which dominates 60% of layer 2 income

Ethereum co-founder Vitalik Buterin has signaled a fundamental shift in the blockchain’s roadmap that declares the era of the “branded shard” effectively over. On Feb. 3, Buterin argued that the industry’s previous “rollup-centric” vision no longer makes sense, citing faster scaling

Bitcoin trapped below $80,000 as the strongest US factory signal since 2022 threatens further liquidations

The United States factory engine just delivered its loudest “risk on” signal in years, and it is landing at a brutally awkward time for Bitcoin. On Feb. 2, Howard Lutnick, the United States Secretary of Commerce, announced that: “The United States has

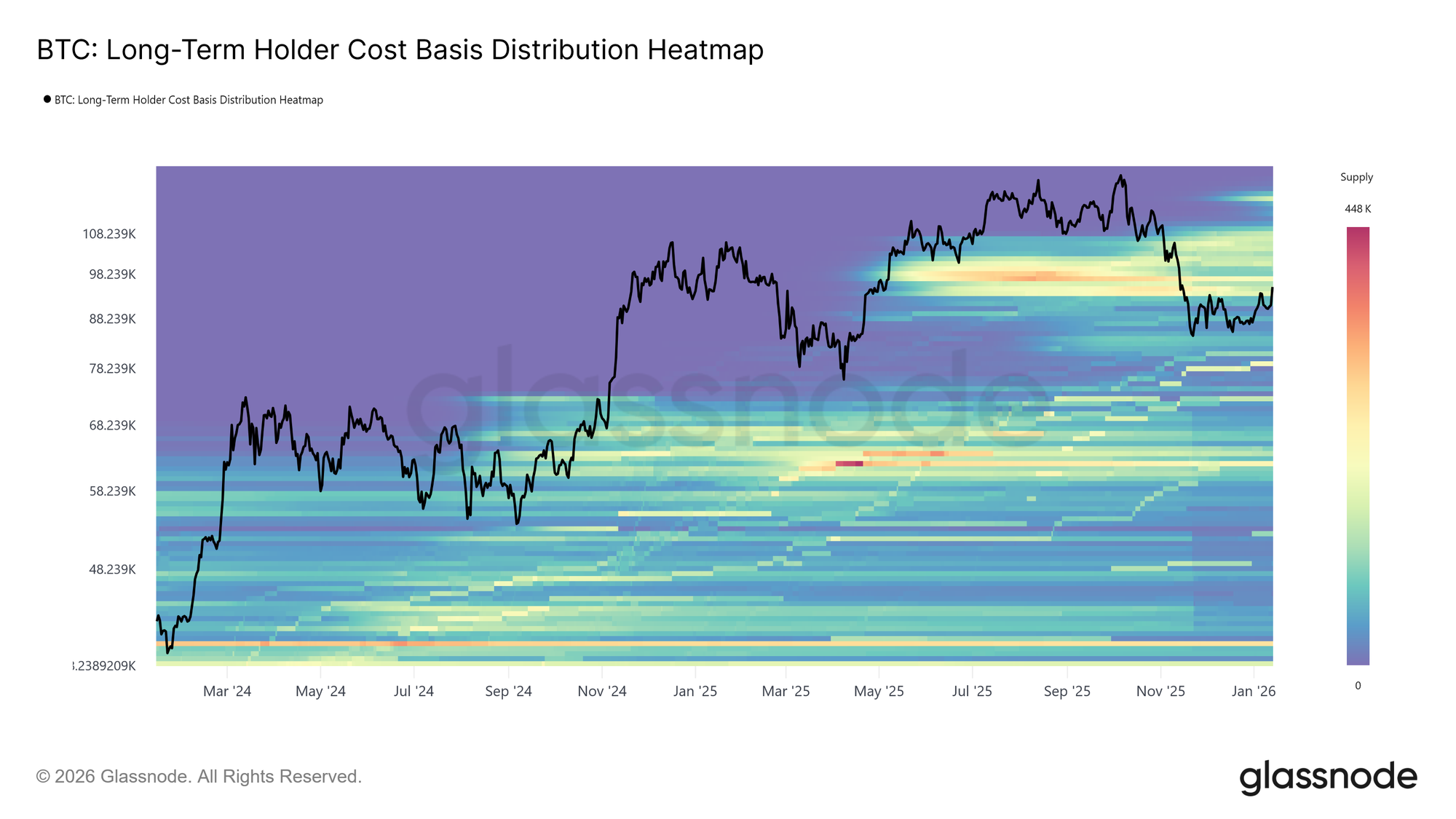

Bitcoin supply guide: When holders sell, miners strain, and ETFs add pressure

Bitcoin supply guide: cost-basis bands, miner stress, and ETF flow signals Bitcoin is currently trading outside a $93,000–$110,000 cost-basis band that Glassnode frames as an “overhead supply” zone. BTC long term holder cost basis distribution heatmap (Source: Glassnode) That setup puts the next

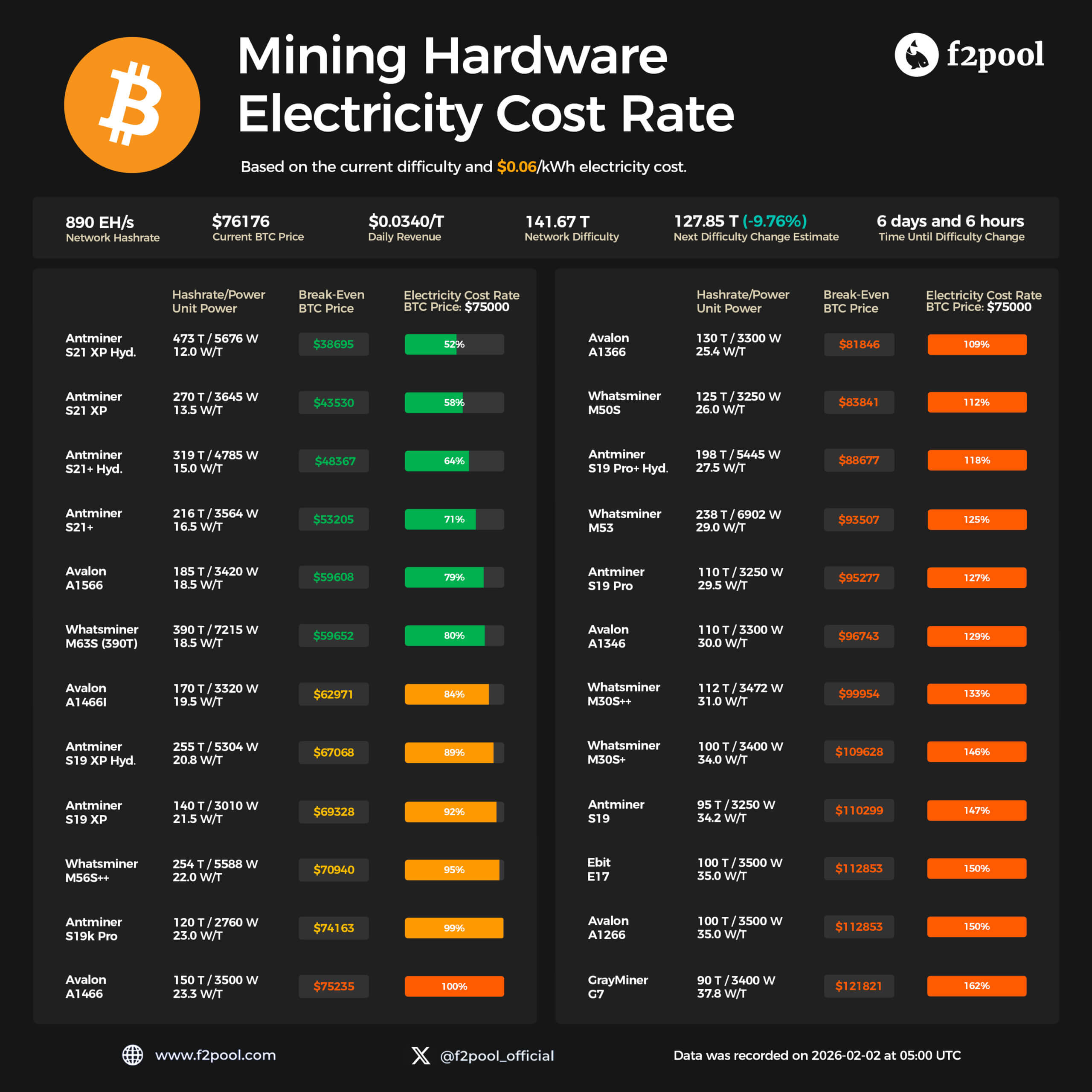

Bitcoin mining revenue hits historic low as infrastructure is sold to AI giants permanently altering the network’s security

The euphoria of October’s record highs has evaporated, leaving the industrial backbone of the Bitcoin network facing a brutal reality check. According to CryptoSlate's data, Bitcoin is currently trading near $78,000, a level that represents a punishing decline of more than

Bitcoin in freefall hitting lowest price since Trump took office as leverage turns a macro wobble into a brutal cascade

Bitcoin fell around 8% on Feb. 3, briefly losing the $73,000 level. A quick rebound took prices to $74,500 as of press time, dampening the intraday correction to 5.8%. The decline marks the lowest price point in the President Donald Trump

The trillion dollar Bitcoin lottery you can play now for free – but will never win

Bitcoin is a $1.5 trillion prize pool secured by nothing more than numbers, private keys, generated by math, that unlock wallets holding real money. That’s the seductive idea behind Keys.lol: a site that spits out batches of Bitcoin private keys and

Groundhog Day for Bitcoin means six more weeks of macro winter if core flows stay deep red

Groundhog Day for Bitcoin: six more weeks of macro winter? Bitcoin got its own Groundhog Day moment today as Punxsutawney Phil “saw his shadow” on the 140th Anniversary of the celebration and signaled six more weeks of winter, just after BTC

UAE royal bought Trump influence through reported $500M investment in WLFI digital dollar

New reports says Abu Dhabi royal Sheikh Tahnoon bin Zayed al-Nahyan, or investors tied to him, agreed in January 2025 to invest $500 million into Trump-linked World Liberty Financial for about a 49% stake. WLFI, the governance token of World Liberty

Japan bond market chaos threatens unprecedented Bitcoin liquidations as the era of free money ends

Japan spent decades as the world’s best destination for the world's easiest funding trade. You could borrow yen at very low rates, buy almost anything with a higher yield, hedge just enough to feel responsible, and assume the Bank of

Bitcoin institutions finally admit this is a bear market – so why do 70% say the price is still undervalued?

In a global investor survey from Coinbase Institutional and Glassnode, 1 in 4 institutions agreed that crypto has now entered a bear market. Yet the majority of institutions still said Bitcoin was undervalued, and most said they had held or

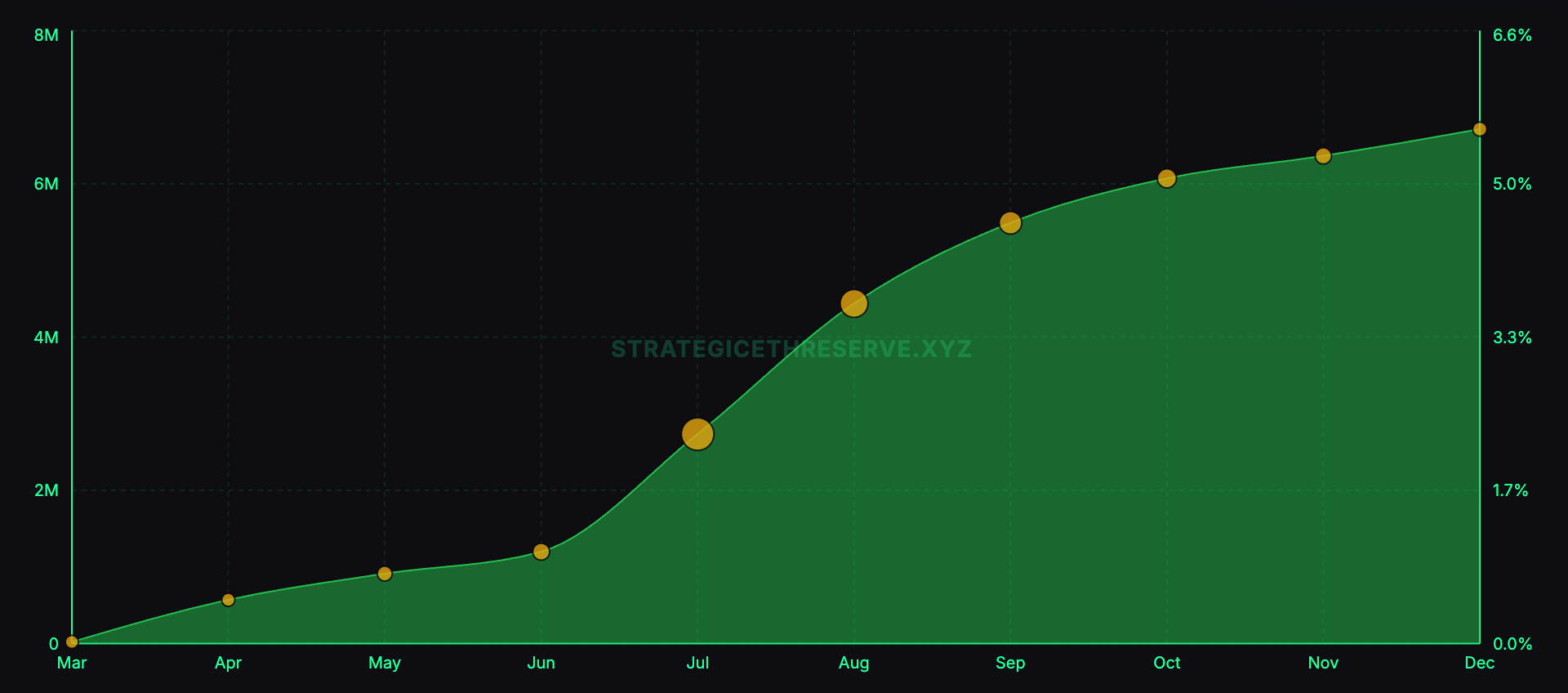

A sudden shift in Ethereum staking is draining billions from exchanges toward a new corporate elite

By the end of 2025, a corner of the market most Ethereum traders rarely watch had built a position large enough to matter for everyone else. Everstake’s annual Ethereum staking report estimates that public companies’ “digital asset treasuries” collectively held roughly