Crypto market bottom is closer than you think as Bitcoin miner reserves crash to historic lows

Bitcoin’s price story lately has been told like it only has one main character, the ETFs. Money goes in, price goes up, money goes out, price goes down. It’s a clean narrative, and it’s not wrong, but it’s incomplete, because Bitcoin

Your US dollar is worth 89 cents today for the same reason Bitcoin traders are actually still winning

If you hold either US dollars or Bitcoin, then you're a little poorer this morning than when you went to bed last night. It doesn't matter whether there's cash in your pocket or sats in your wallet; both have less

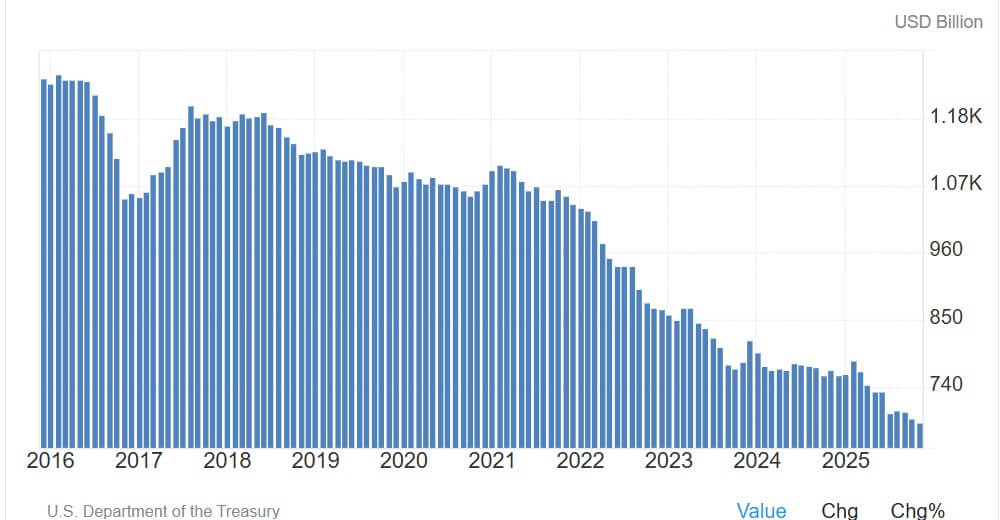

Why Bitcoin faces a brutal liquidity trap because China’s $298B of US Treasuries are up for sale

China’s gradual retreat from US government debt is evolving from a quiet background trend into an explicit risk-management signal, and Bitcoin traders are watching the market for the next domino. The immediate trigger for this renewed anxiety came on Feb. 9

Bitcoin short term holders are panic selling at a loss but was this capitulation or just a leverage reset?

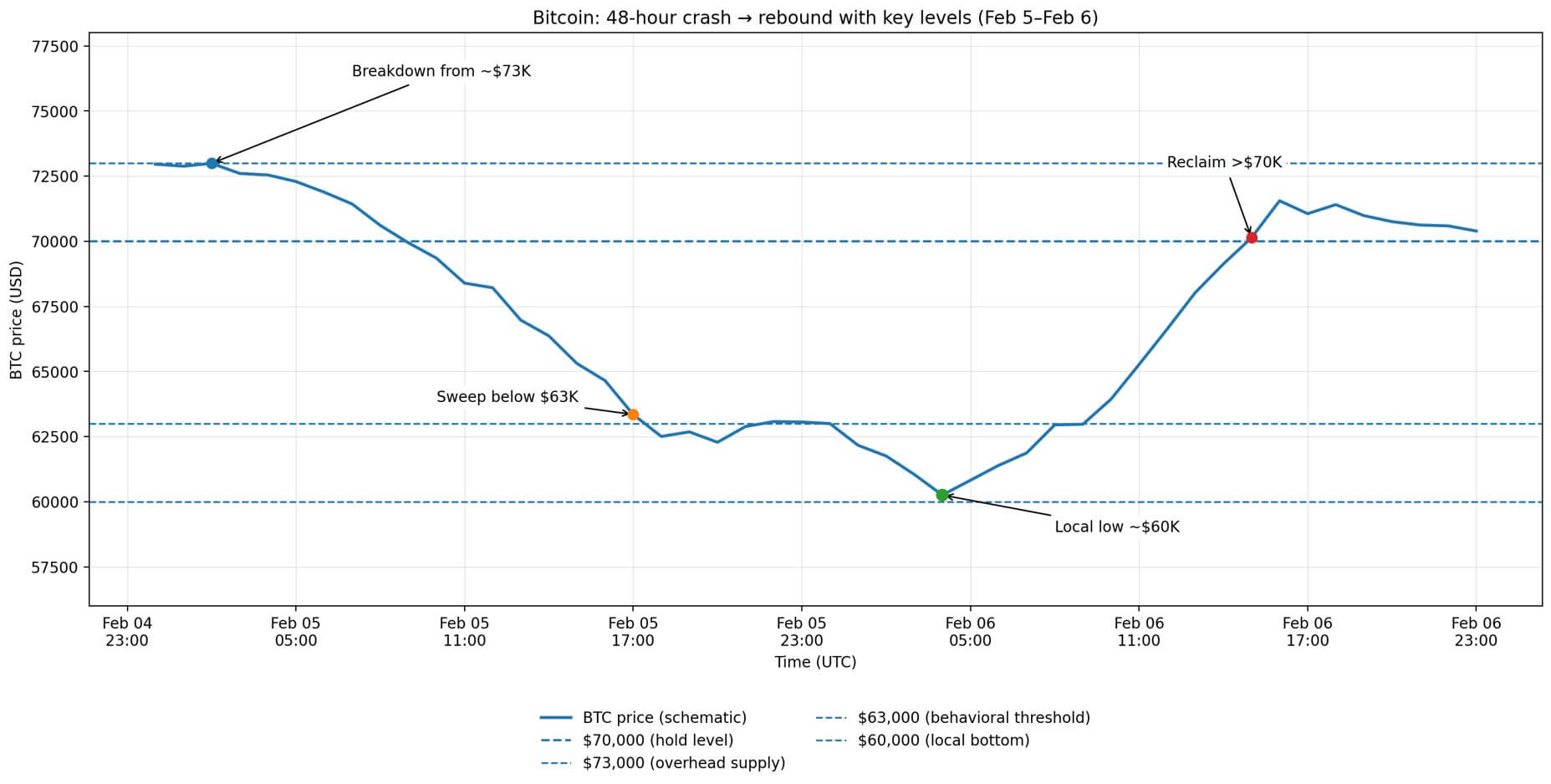

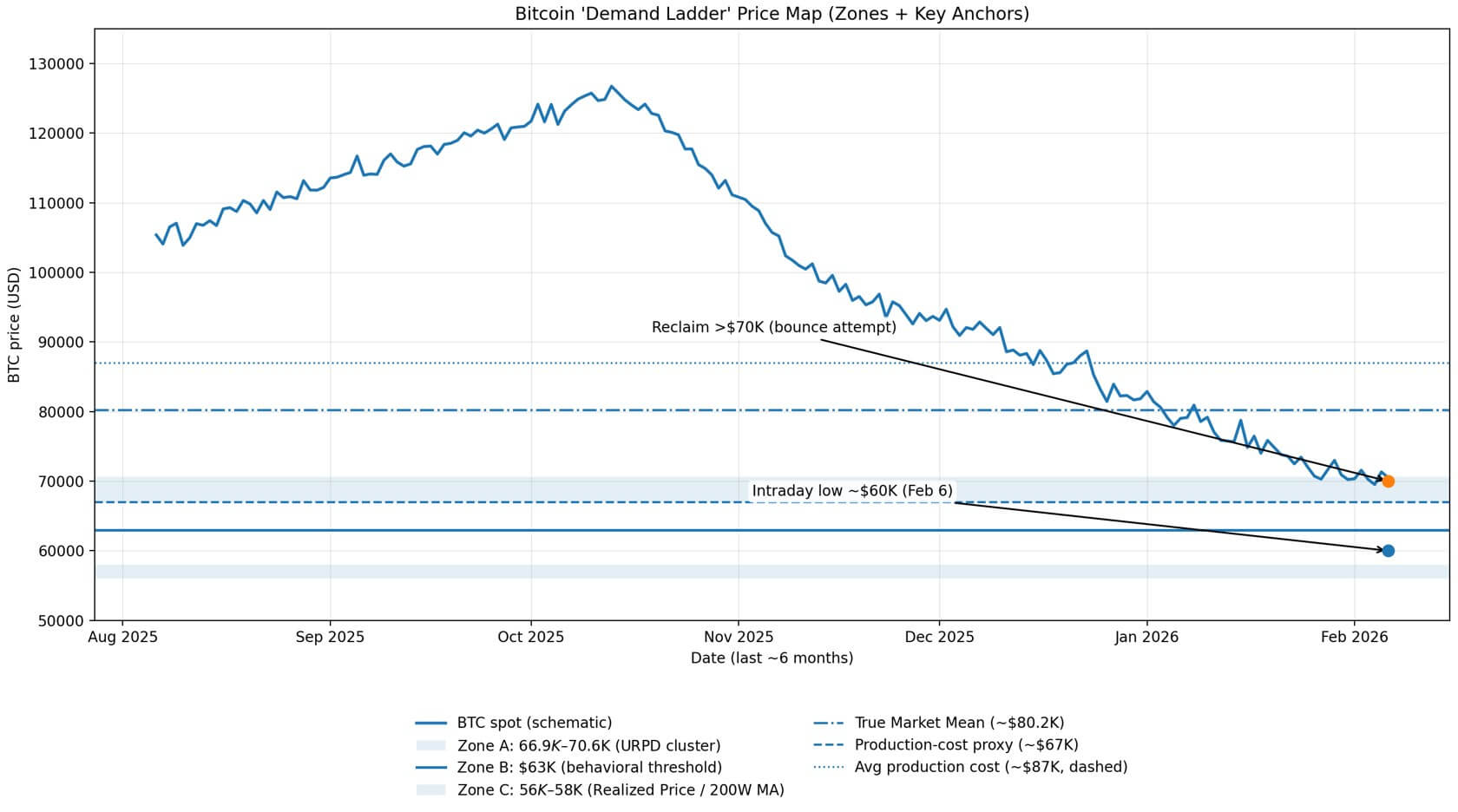

Bitcoin’s slide through $65,000 and toward $60,000 felt like a stress test the market had been postponing. The move was sharp enough to force a reset in positioning, and broad enough to pull the conversation away from single-catalyst explanations. Even mainstream media

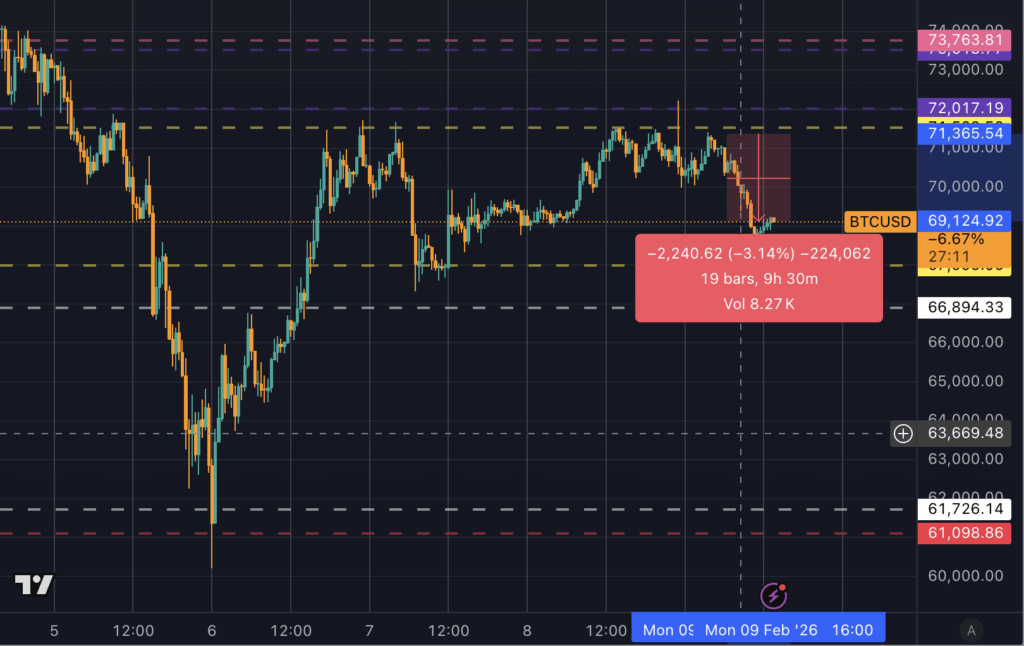

Bitcoin must retake $71,500 very soon or the mid-range drift back toward $61,000 begins

Bitcoin keeps knocking on $71,500, sooner or later the door opens Bitcoin made a familiar but stressful move this week; it bounced hard enough to make the skeptics quiet and the dip buyers loud again. After the crash down to around $60,000,

Do CME gaps always have to fill? Bitcoin’s $60k flush says no

Bitcoin trades every minute of every day, but CME Bitcoin futures stop for the weekend. That mismatch is how a CME gap is born, and why it keeps turning up in the middle of the most stressful weeks. A CME gap

Bitcoin ETF flow numbers are fundamentally broken and most traders are missing the specific sign of a crash

On Jan.30, 2026, US spot Bitcoin ETFs saw $509.7 million in net outflows, which looks like pretty straightforward negative sentiment until you look at the individual tickers and realize a few of them stayed green. That contradiction aged fast over the

Bitcoin bears could sleepwalk into a $8.65 billion trap as options max pain expiry nears $90,000

Bitcoin’s next big options gravity well sits on Mar. 27 (260327), and the reason is simple: this is where the market has parked a thick stack of conditional bets that will need to be unwound, rolled forward, or paid out

Bitcoin rocketed up 15% to get back above $70,000 but the options market is currently pricing in a terrifying new floor

Bitcoin ripped from $60,000 to above $70,000 in less than 24 hours, erasing most of a brutal 14% drawdown that had tested every bottom-calling thesis in the market. The speed of the reversal, 12% in a single session and 17% off

Bitcoin now at a price level it has always defended and the current $67,000 BTC mining cost matters

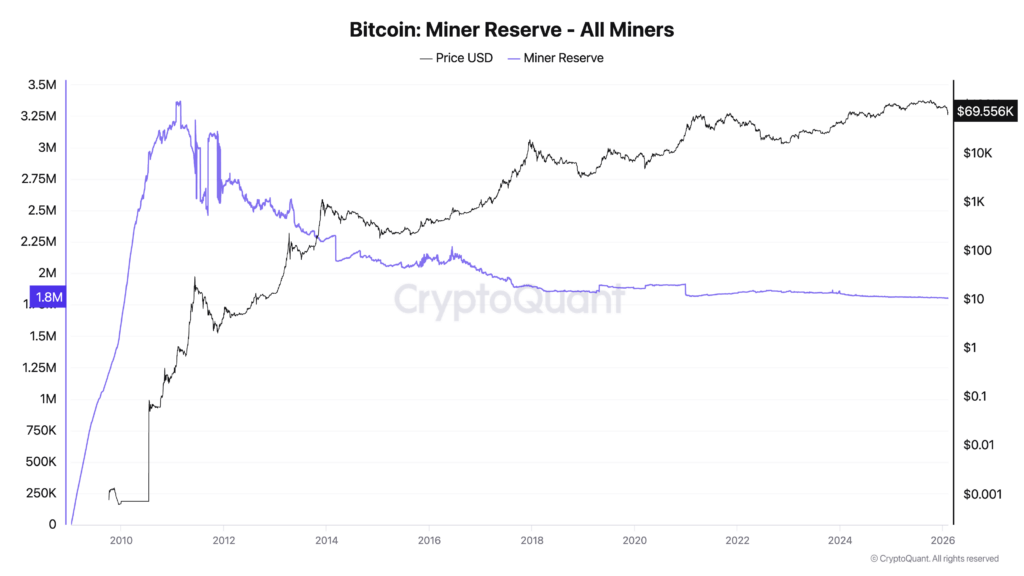

Trader Plan C recently surfaced a chart indicating a production-cost model placing Bitcoin's marginal mining expense at approximately $67,000, with historical price action showing repeated bounces off that red line. He added that “commodities rarely trade below their cost of production.”

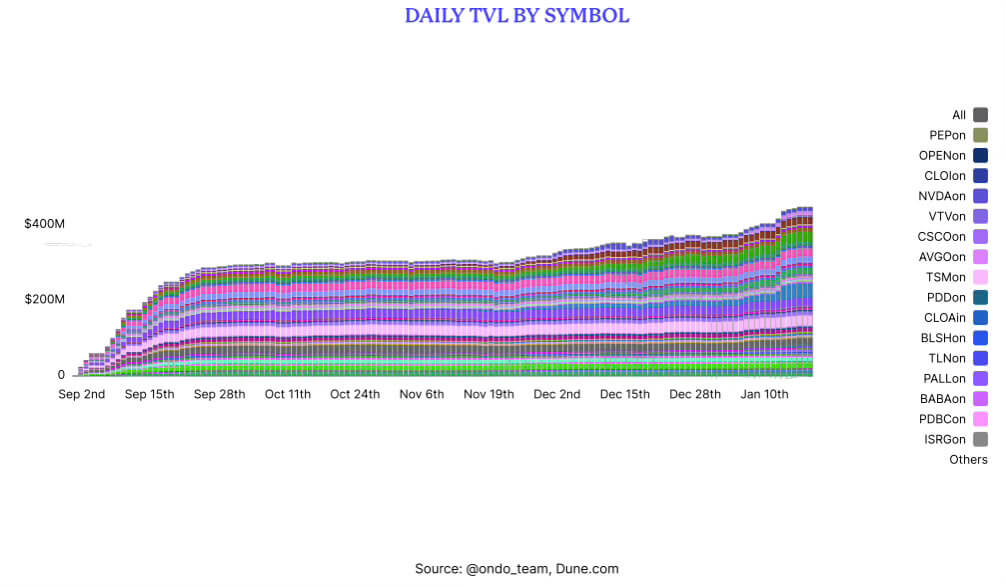

Tokenized equities approach $1B as institutional rails emerge

The following is a guest post and analysis from Vincent Maliepaard, Marketing Director at Sentora. A year ago, tokenized equities barely registered as an asset class. Today, the market is approaching $1 billion—a nearly 30x increase—and December 2025 may have delivered

Why I’m bullish when my $49k Bitcoin prediction is playing out as BTC closes in on major BUY ZONE

Bitcoin has a way of turning numbers into memories. You remember the first time it ripped through a round number, $10k, $20k, $100k, you remember the mood shift when it stops rewarding optimism, you remember the quiet weeks when every bounce

Monero and Zcash Fall Over 28% in Past Week, but Privacy Peer ZANO Holds Steady

XMR dropped to $311 and ZEC to $221 over seven days while ZANO declined just 1.4% as Fear & Greed hit 9. Key Notes Monero fell 28.9% and Zcash dropped 33.4% over the past week while ZANO declined just 1.4% Fear & Greed

Bitcoin miners have the one thing AI still needs and Big Tech has $500 billion to buy it

Big Tech companies' planned $500 billion war chest to dominate artificial intelligence could offer a lifeline to a Bitcoin mining industry teetering on the edge of capitulation. The headline numbers are eye-watering. Alphabet, Google’s parent, alone plans to spend as much

Ethereum collapses below $2,000 after Vitalik Buterin and insiders moved millions to exchanges into thin liquidity

Ethereum co-founder Vitalik Buterin and other prominent “whales” have offloaded millions of dollars in ETH since the beginning of February, adding narrative fuel to a market rout that saw the world's second-largest cryptocurrency tumble below $2,000. While the high-profile sales by

Bitcoin whales are dumping massive amounts of supply on exchanges as liquidations mirror the 2022 FTX market collapse

Bitcoin experienced a steep decline over the last 24 hours, pushing its price to approximately $60,000 amid an accelerated selloff comparable to the 2022 FTX collapse. BTC had recovered to $69,800 as of press time, according to CryptoSlate data. Still, Glassnode data

Bitcoin in critical warning zone threatening a 42% drop before the new bull run can start

Bitcoin is back in that familiar place where the chart looks ugly, the timeline feels loud, and everyone is trying to guess whether the next move is the one that finally breaks the mood. Today, Bitcoin fell below $70,000 for the

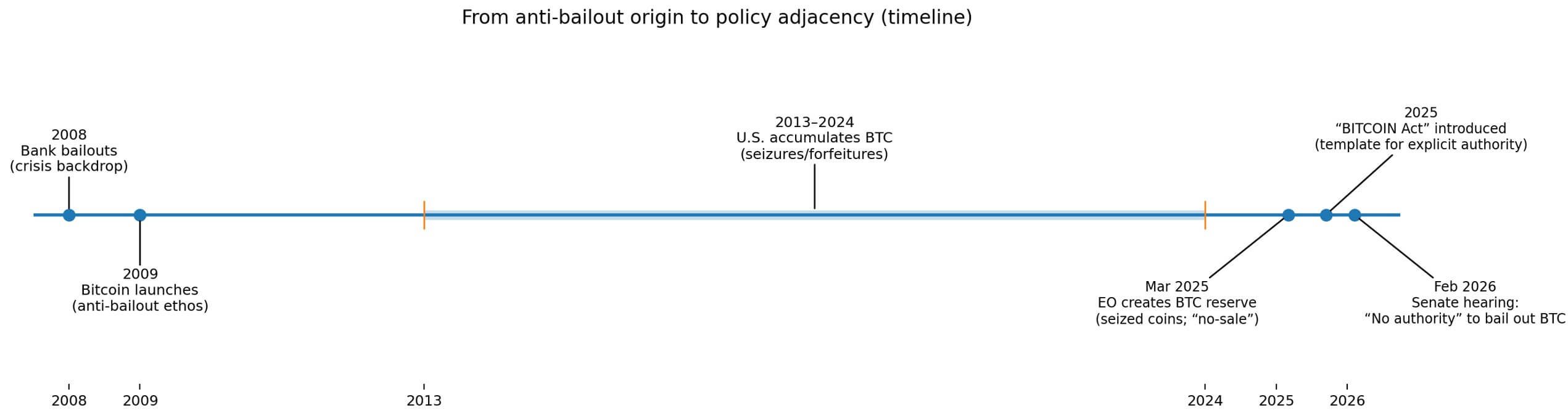

Bitcoin faces a brutal irony as the Treasury refuses to save BTC from its own political success

Treasury Secretary Scott Bessent told Congress he has no authority to bail out Bitcoin. The exchange came during a Senate Banking Committee hearing, when Senator Brad Sherman asked whether the Treasury could intervene to support cryptocurrency prices. Bessent's answer was direct: