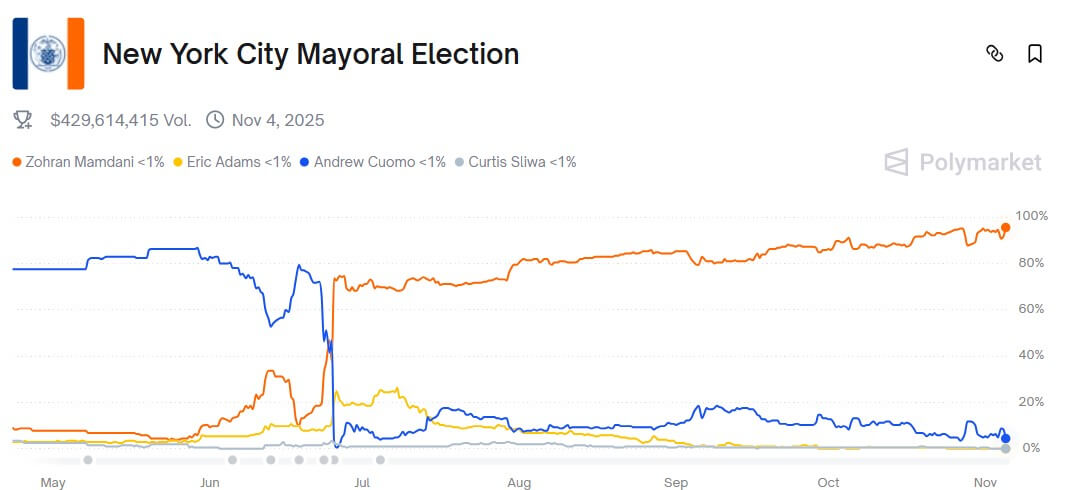

How Zohran Mamdani’s victory impacts New York’s crypto future

Zohran Mamdani’s win has put New York’s crypto sector on edge, raising questions about how a mayor critical of both Wall Street and digital-asset wealth will steer the city. On Nov. 4, the 34-year-old Democrat defeated former New York Governor Andrew

How Saylor and Strategy plan to kickstart Bitcoin buying internationally

After years of relentless buying, Strategy Inc., the digital-asset treasury firm led by Michael Saylor, has quietly eased its pace of Bitcoin accumulation. In recent weeks, company filings have shown that its BTC purchases have fallen to only a few hundred

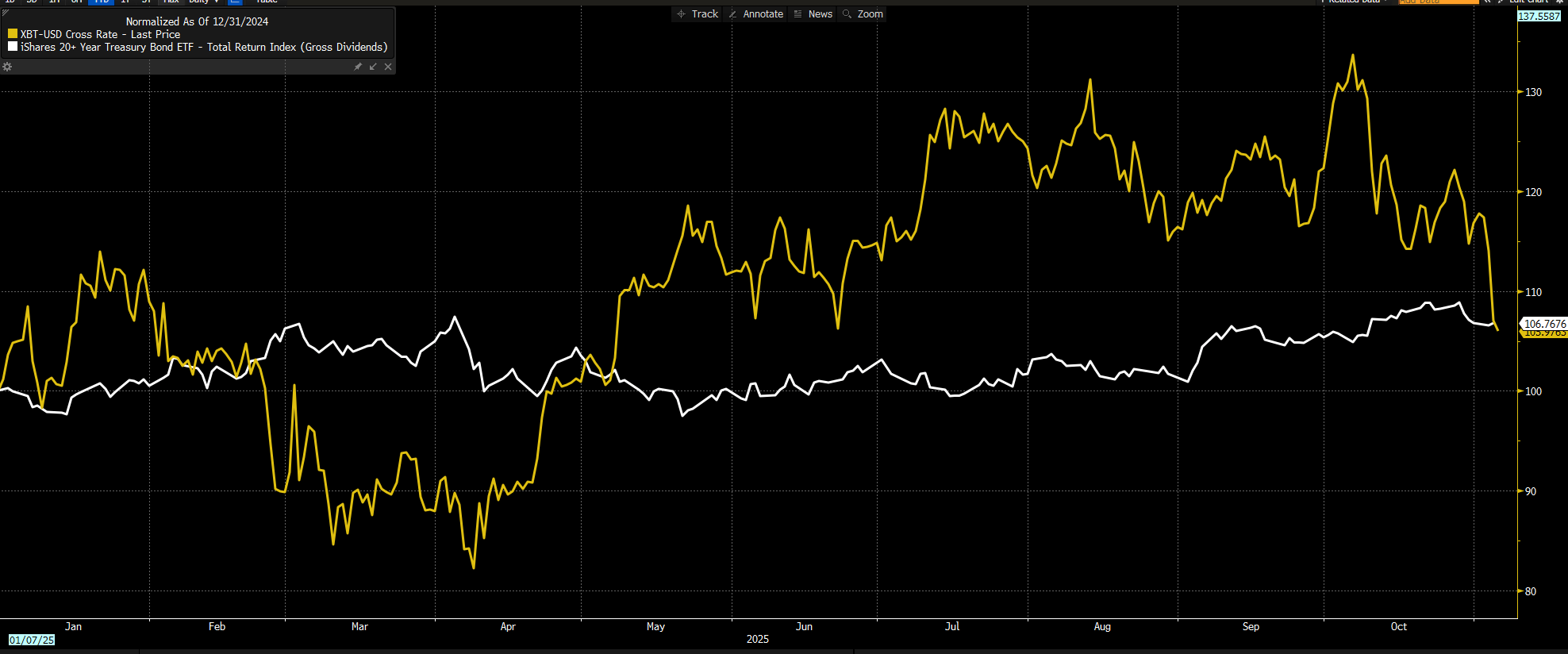

Bitcoin bear market OR bear trap? Here’s what your ‘quants’ are saying

Bitcoin’s sustained price above $100,000 was supposed to signal its arrival as a mature institutional asset. Instead, its sudden reversal below that threshold has unsettled traders and revived fears of another crypto winter. On Nov. 4, Bitcoin briefly dipped to its

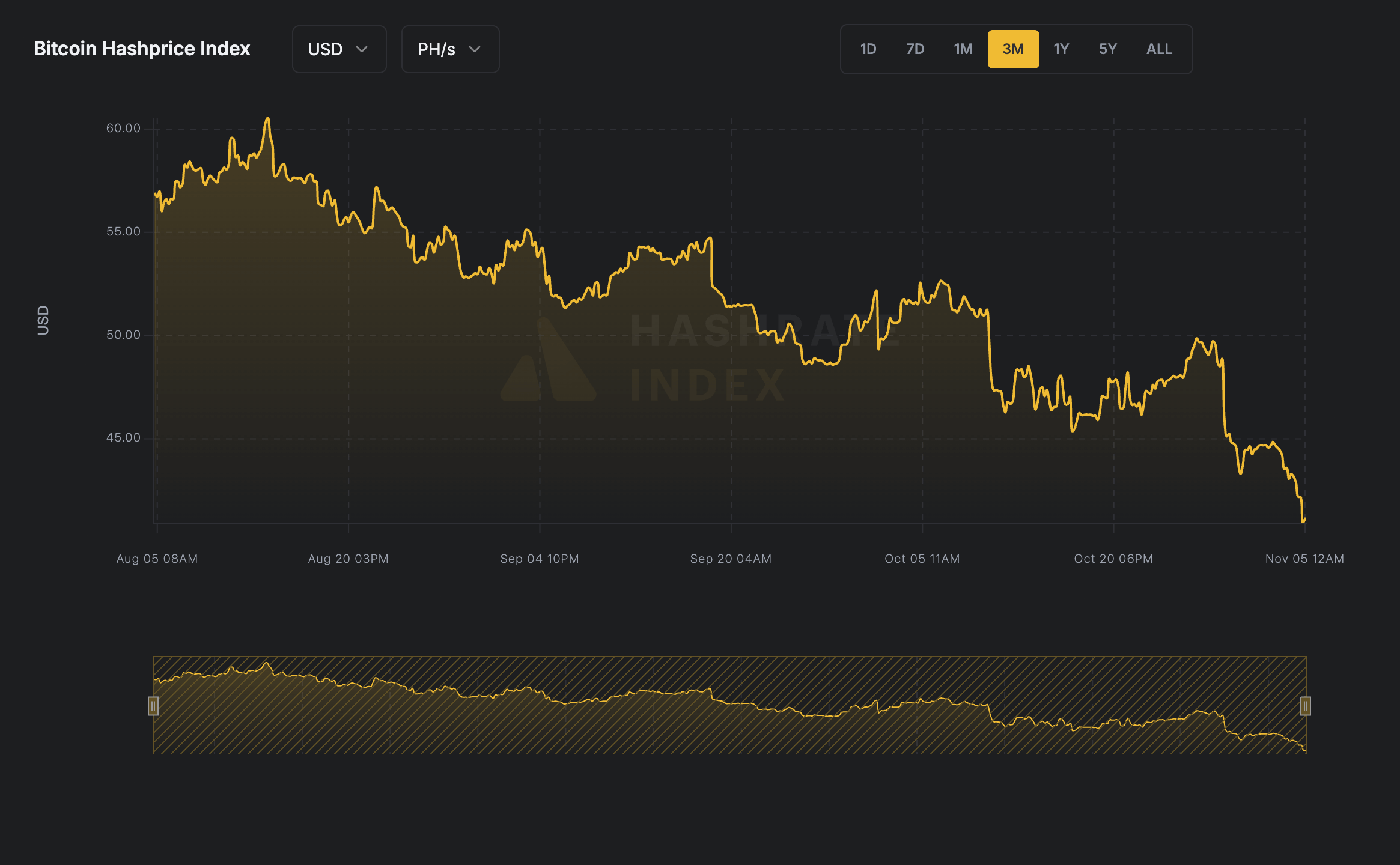

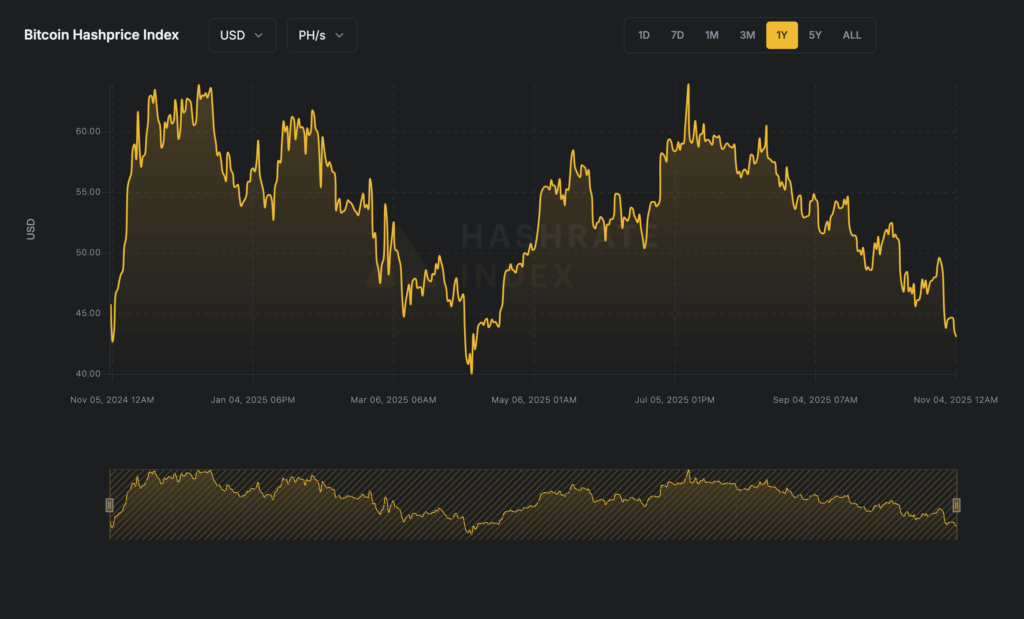

Bitcoin hashprice sinks to 2-year low as AI pivots split miners

Record difficulty and declining on-chain fees have dragged Bitcoin mining profitability to a two-year low, creating a widening divide between miners surviving on razor-thin margins and those reinventing themselves as data-center operators for the AI boom. Mining used to be a

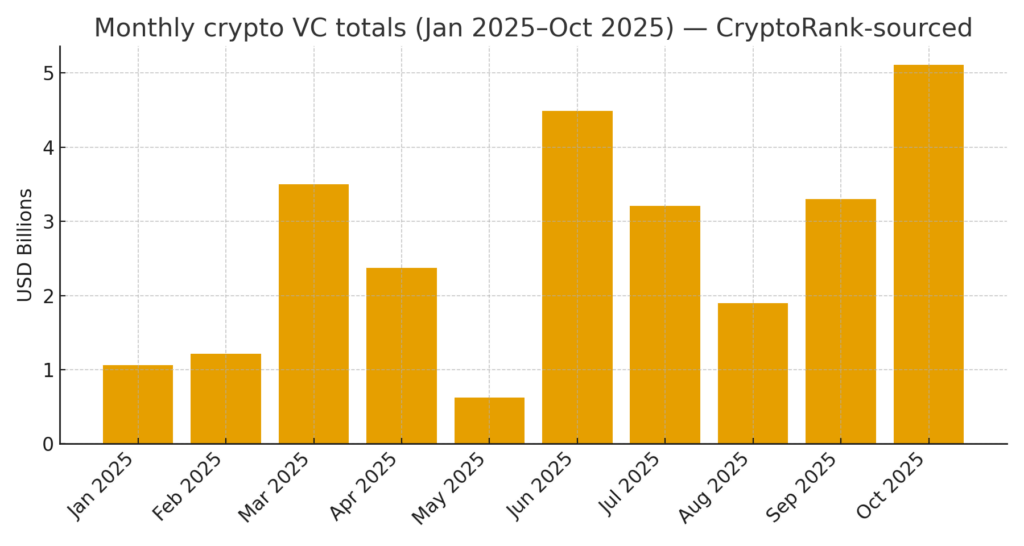

VCs pour $5.1B into crypto firms while Bitcoin’s ‘Uptober’ whiffed

October closed roughly 4% down for Bitcoin, yet venture funding hit $5.1 billion in the same month, the second-strongest month since 2022. According to CryptoRank data, three mega-deals account for most of it, as October defied its own seasonal mythology. Bitcoin fell

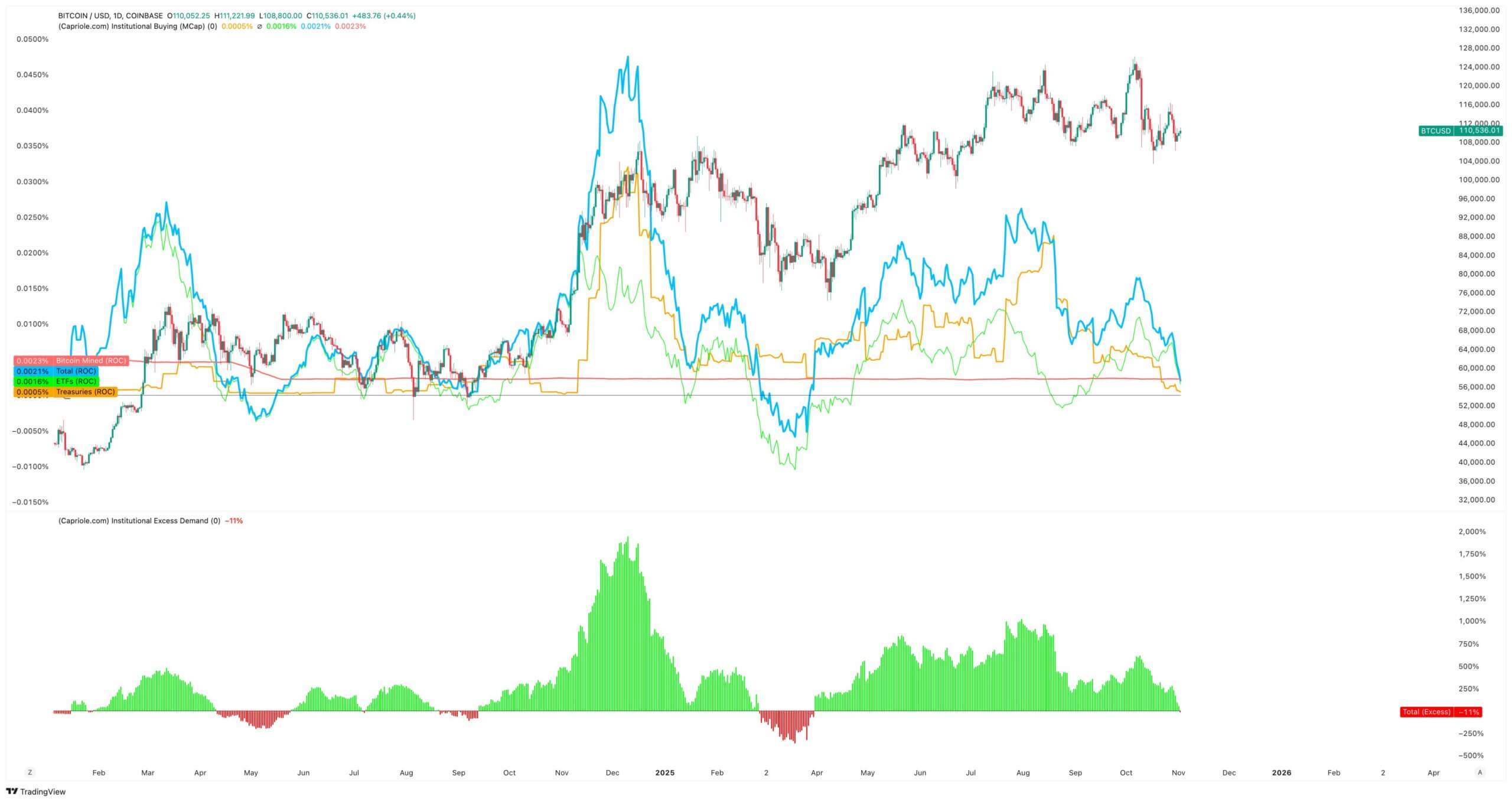

5 clear signals that will prove if the Bitcoin bull run is still alive

Crypto Twitter is filled with claims that “everyone is buying Bitcoin”, from Michael Saylor and BlackRock to entire countries and even banks. Yet despite the accumulation narratives, Bitcoin’s price has slipped sharply, breaking below key levels as ETF flows turned negative. The

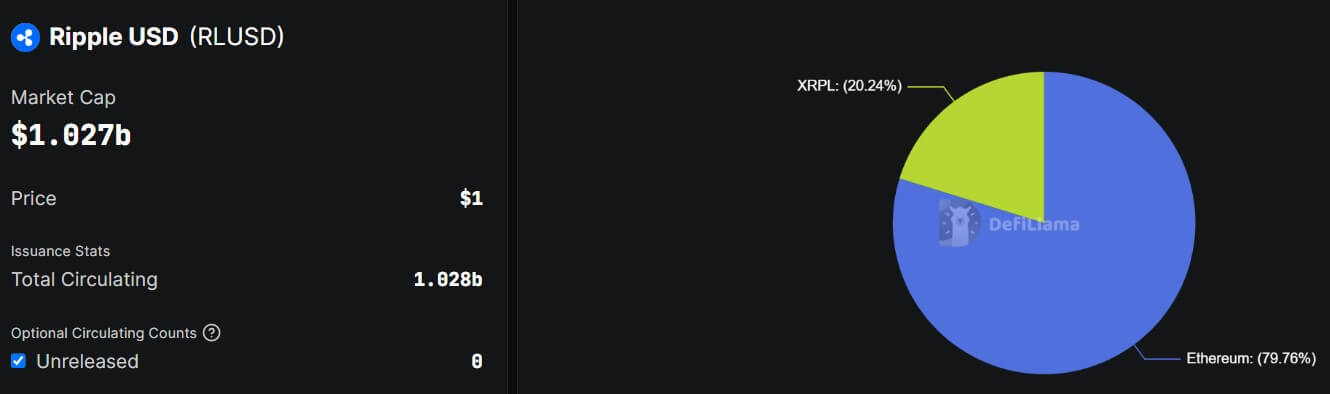

How XRP and RLUSD are making Ripple the JPMorgan of the crypto industry

For years, Ripple was best known for its legal battles and its token, XRP, which was a symbol of crypto’s friction with the traditional financial world. Now, after years of courtroom and regulatory turbulence, Ripple has quietly built something far more

Why did Bitcoin’s largest buyers suddenly stop accumulating?

For most of 2025, Bitcoin’s floor looked unshakable, supported by an unlikely alliance of corporate treasuries and exchange-traded funds. Companies issued stock and convertible debt to buy the token, while ETF inflows quietly soaked up new supply. Together, they created a

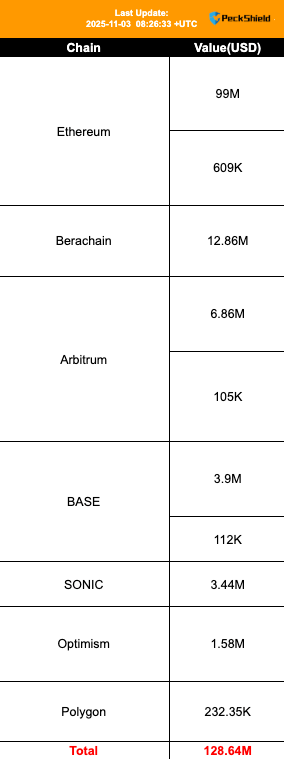

How 11 audits couldn’t stop Balancer’s $128 million hack redefining DeFi risks

For years, Balancer stood as one of DeFi’s most reliable institutions, a protocol that had survived several bear markets, audits, and integrations without scandal. However, that credibility collapsed on Nov. 3, when the blockchain security firm PeckShield reported that Balancer and

Bitcoin fights to sustain its bull run while fees slide 56% YTD

Bitcoin is having a strangely quiet year on-chain. After a wave of speculative flows in 2024, the network now moves with near-clockwork efficiency. The average block size has contracted, daily fees are less than half what they were in January, and

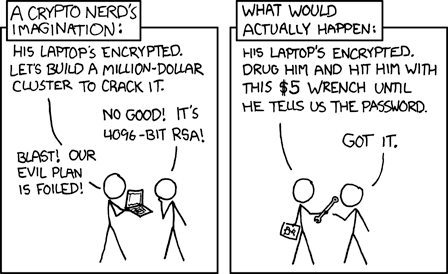

When the wrench comes for the wallet: Why Bitcoin’s biggest believers are handing over their keys

Welcome to Slate Sunday, CryptoSlate’s weekly feature showcasing in-depth interviews, expert analysis, and thought-provoking op-eds that go beyond the headlines to explore the ideas and voices shaping the future of crypto. Self‑custody was once the ultimate badge of credibility in crypto. A

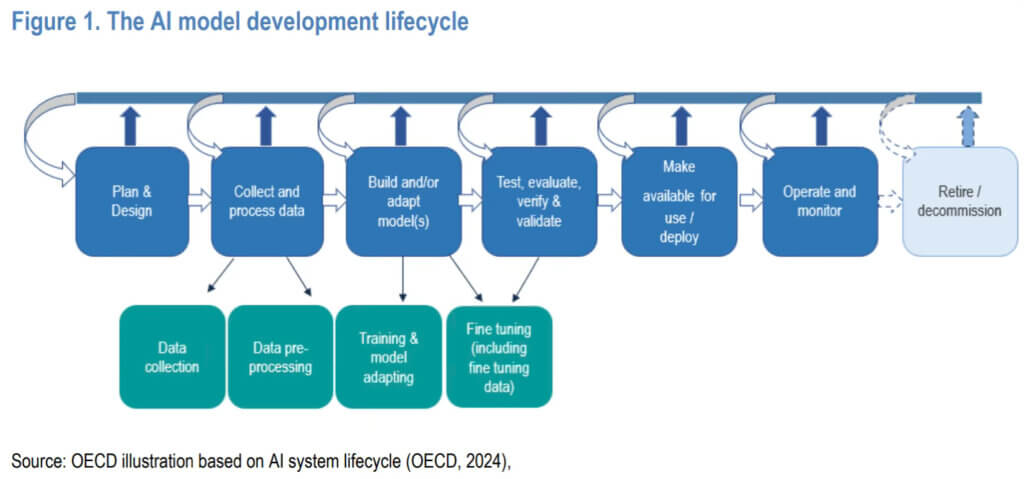

Can blockchain tame AI’s IP problem?

The following is a guest post and opinion from Shane Neagle, Editor In Chief from The Tokenist. It is no secret that large language models (LLMs) crossed the capability threshold by harvesting vast amounts of public and private data. Combined with

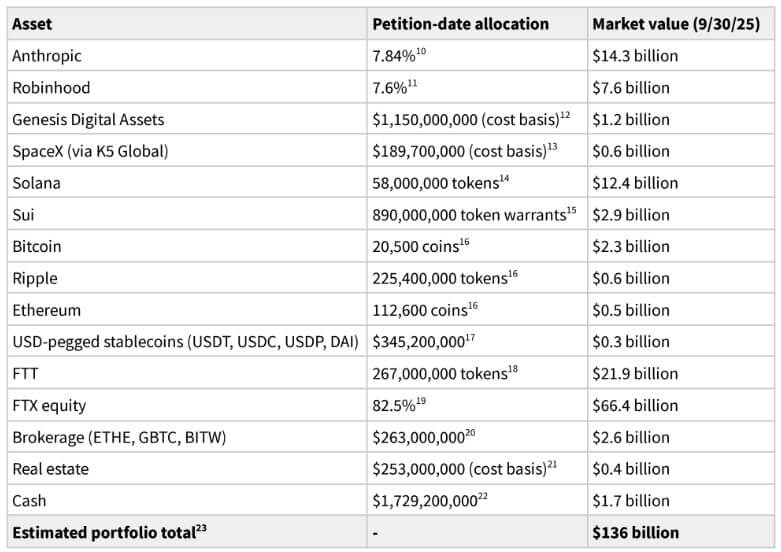

New prison report flouts claim FTX could have repaid customers from $25B in assets

Sam Bankman-Fried is again challenging the core narrative of his downfall: that FTX was insolvent when it collapsed in November 2022. In a 15-page report written from prison and dated Sept. 30, the convicted founder claimed the exchange “was never insolvent”

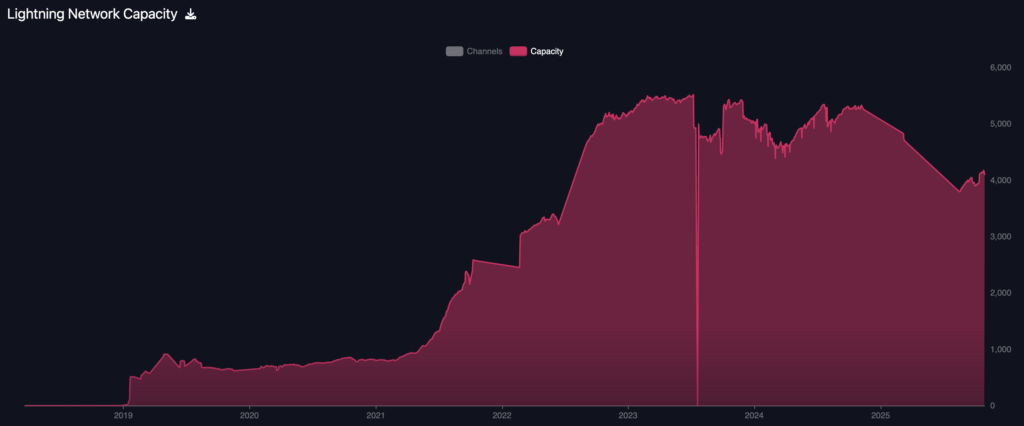

Invisible Lightning: Why exchange channels break a favorite Bitcoin metric

The Bitcoin Lightning Network was once the crown jewel of Bitcoin’s scaling story, a living map of open channels and growing liquidity that reflected adoption in real-time. However, as the network matures, the picture has blurred. Behind the steady decline in

The first AI launchpad on Sui: Empowering retail investors to invest like VCs

I. The Consensus Has Arrived: Crypto Belongs to AI Agents Google recently launched the Agent Payments Protocol (AP2), bringing together crypto heavyweights including Ethereum Foundation, Mysten Labs, and MetaMask. A clear consensus is crystallizing: cryptocurrency will become the native economic language of

Does Bitcoin Power Law model still work in 2025 after S2F failed?

With S2F in the rearview, the live power-law channel indicates that BTC is roughly 20% below fair value, but ETF flows could push it to either extreme. Bitbo’s implementation of Giovanni Santostasi’s model places the price near $109,700, the fair value near $136,100,

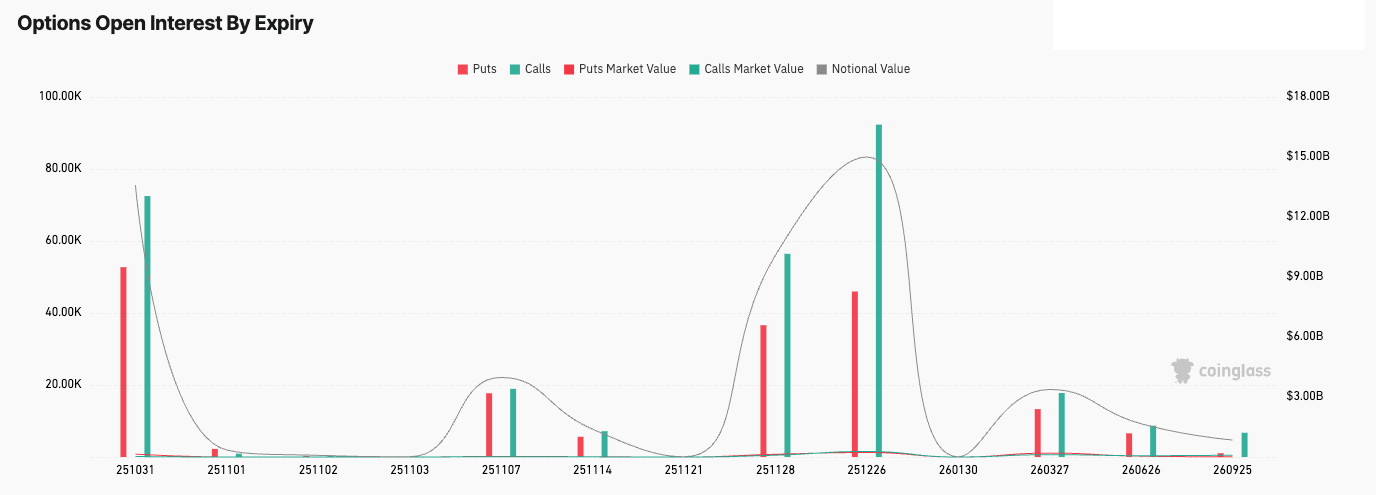

Why $13B in Bitcoin options expiring this week is a price nothing burger

Every few months, headlines warn of a looming multi-billion-dollar options expiry poised to shake Bitcoin price. This quarter’s figure, roughly $13 billion in notional contracts, sounds dramatic, yet it’s part of a well-worn pattern on Deribit, the exchange that clears nearly

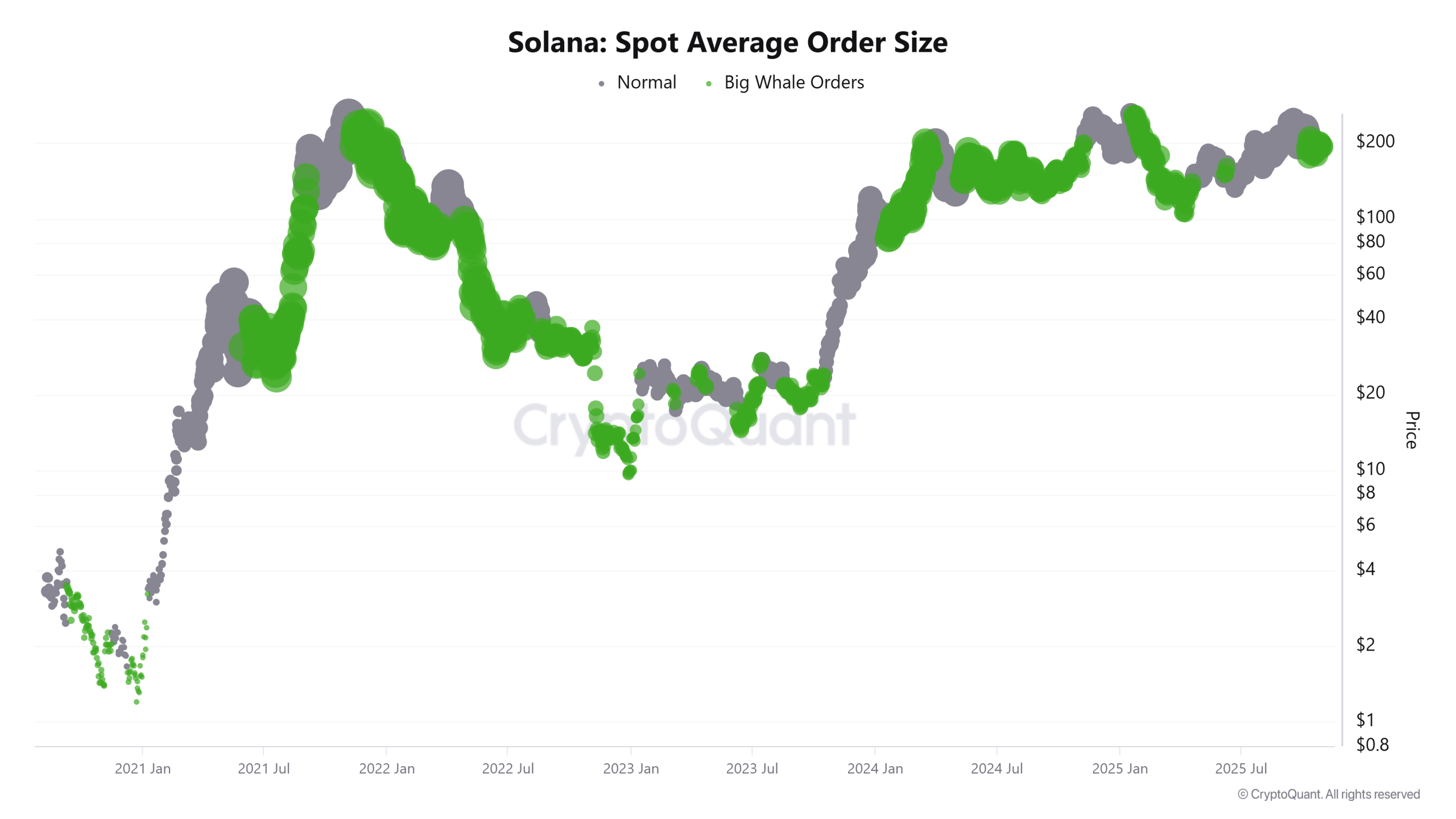

Whales awaken as old SOL hits exchanges but $117M ETF inflows soak up supply

Solana exhibits an on-chain pattern that appears bearish at first glance but becomes constructive when considered alongside capital flows into regulated investment products. Over the past month, early Solana holders, investors who accumulated during quieter market phases, have begun moving older