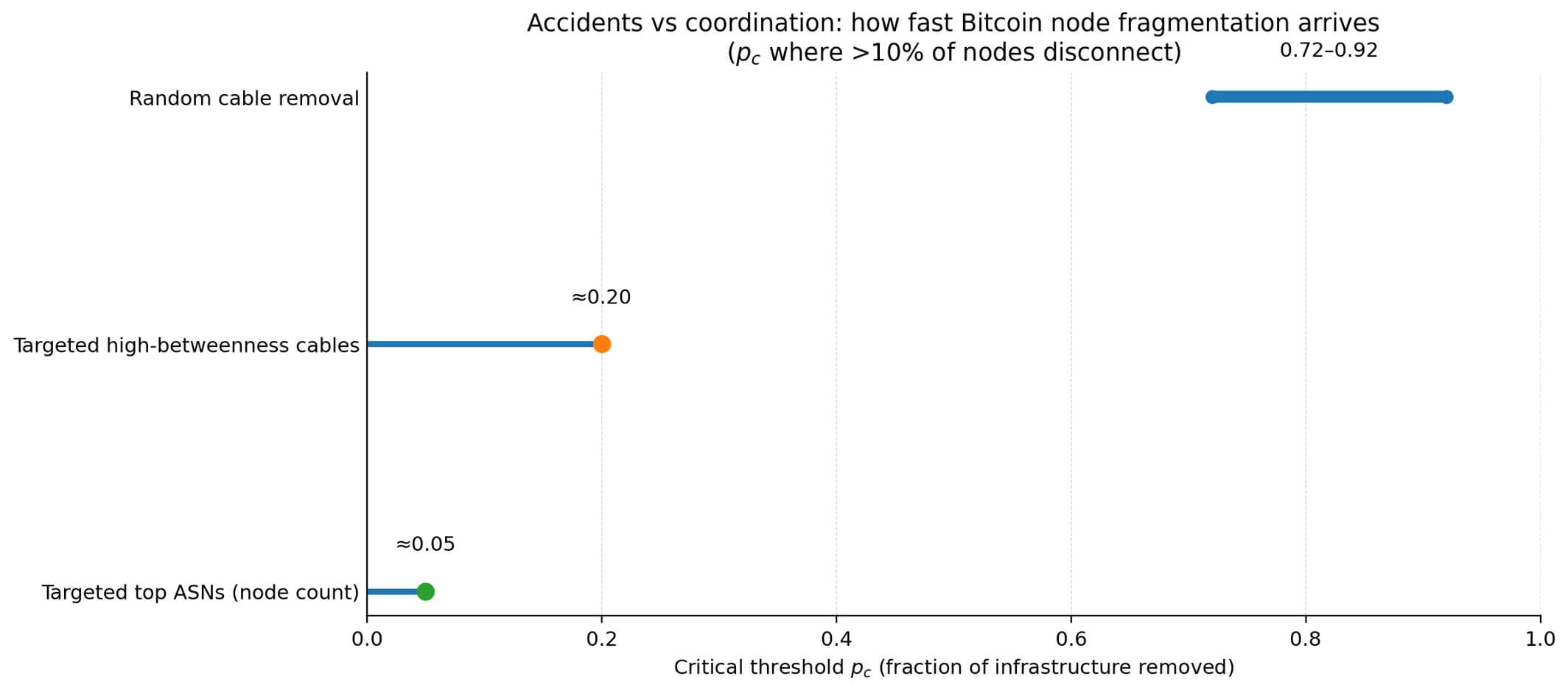

Seven internet cables were cut at once — Bitcoin barely noticed, but researchers found a real chokepoint

When seabed disturbances off Côte d'Ivoire severed seven submarine cables in March 2024, the regional internet impact earned an IODA severity score above 11,000. For Bitcoin, the global effect was negligible. The affected region hosted roughly five nodes, about 0.03% of

New model proves miners need Bitcoin above $74k to break even on power – but other costs push it over 6 figures

Riot case study shows US Bitcoin miners can clear power costs long before they clear full profit Bitcoin mining costs are often reduced to a single number: the “cost to mine one BTC.” In reality, that figure depends on what layer

Forget CPI and ETFs — oil prices may now be the biggest signal for Bitcoin

When crude starts leading the headlines, crypto people tend to ask the wrong questions, like what it is that oil actually does to Bitcoin. While it's the simplest and easiest way to explain what you don't know, it's a pretty bad

$19B could “vanish” from Bitcoin ETFs without a single Bitcoin being sold

Headlines about Bitcoin ETF outflows often mix two things: Bitcoin's price move and actual share redemptions. If BTC drops, ETF AUM drops in dollars even if nobody sells a single share. That mark-to-market drop gets read as money leaving, and it

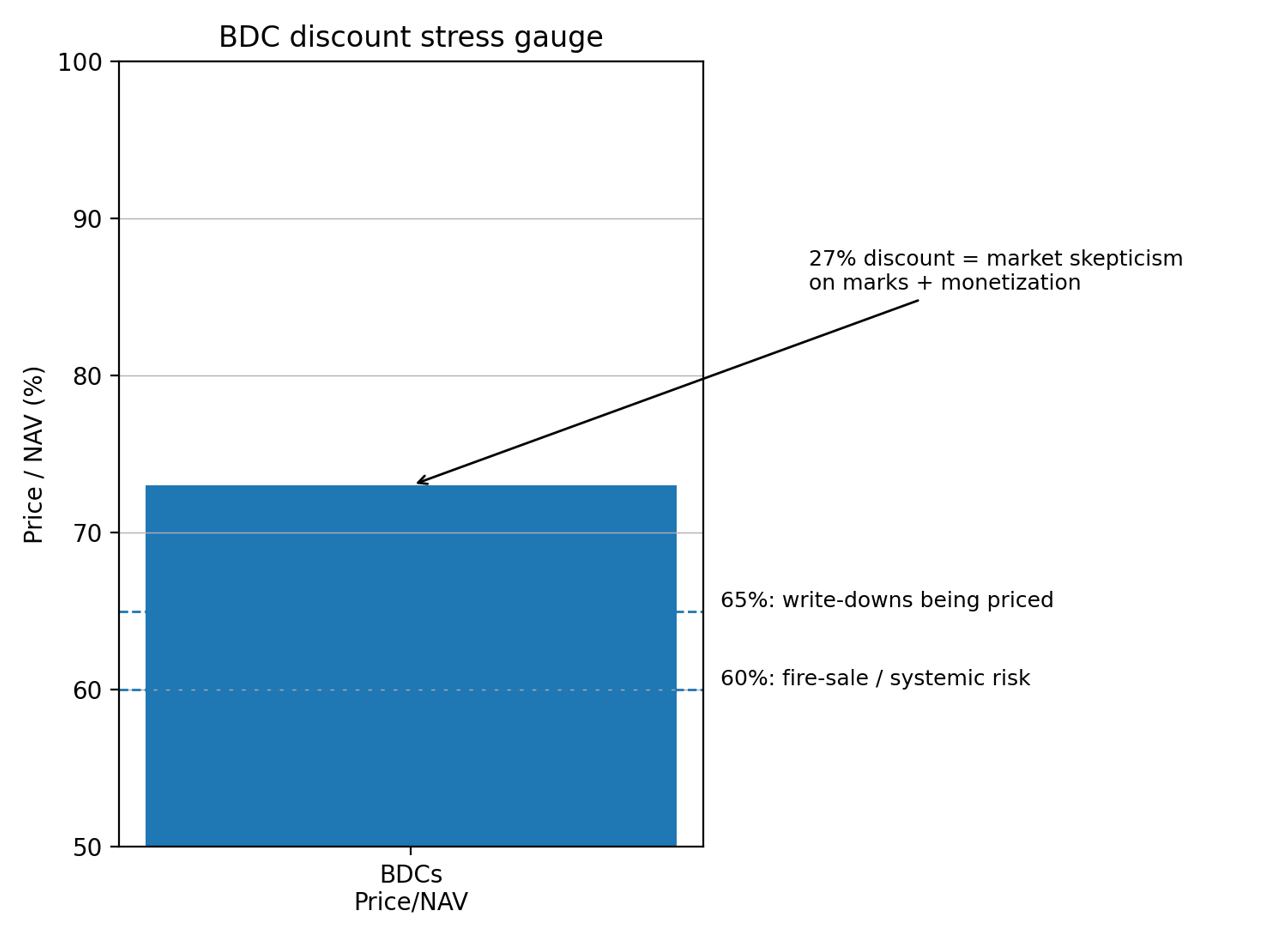

$875B in property debt is due soon — and regional banks may be the weak link Bitcoin is watching

A large volume of US commercial real estate (CRE) debt is rolling into a very different market from the one that produced it. The Mortgage Bankers Association says $875 billion of commercial and multifamily mortgages are scheduled to mature in 2026,

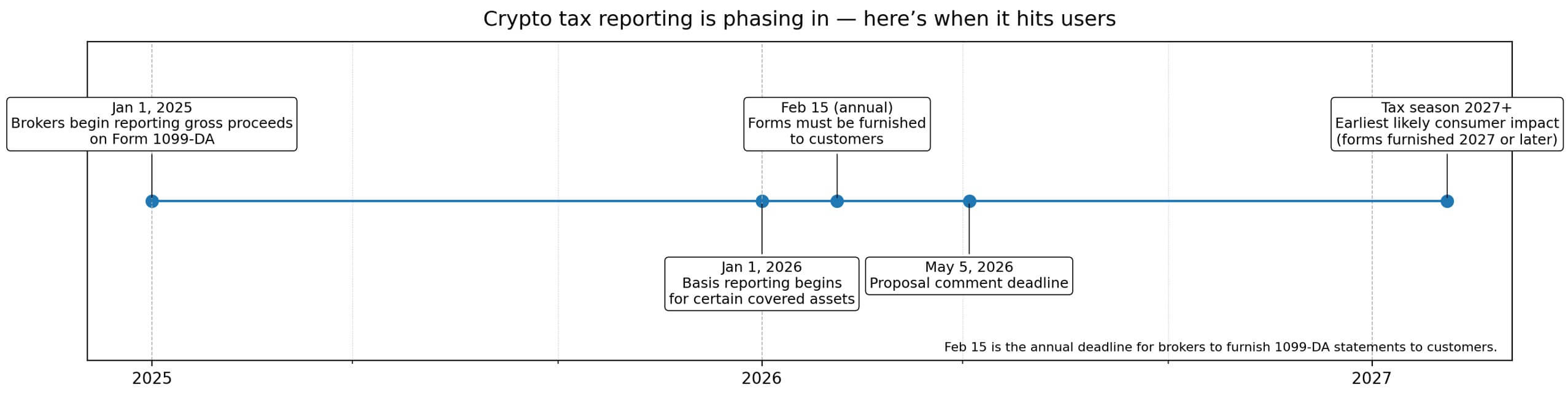

Refusing new IRS crypto tax forms could cost you your exchange account

Log in to Coinbase next tax season, and your tax documents might no longer arrive by mail. Under a new IRS proposal, crypto exchanges could be required to file Form 1099-DA electronically. This form reports digital asset trades, and could refuse

The $3 trillion private credit boom is starting to crack — and Bitcoin could feel it first

Blue Owl Capital's OBDC II fund permanently halted redemptions in February. The firm replaced quarterly tenders with return-of-capital distributions funded by loan repayments and asset sales, committing to return roughly 30% of net asset value within 45 days. Blue Owl also

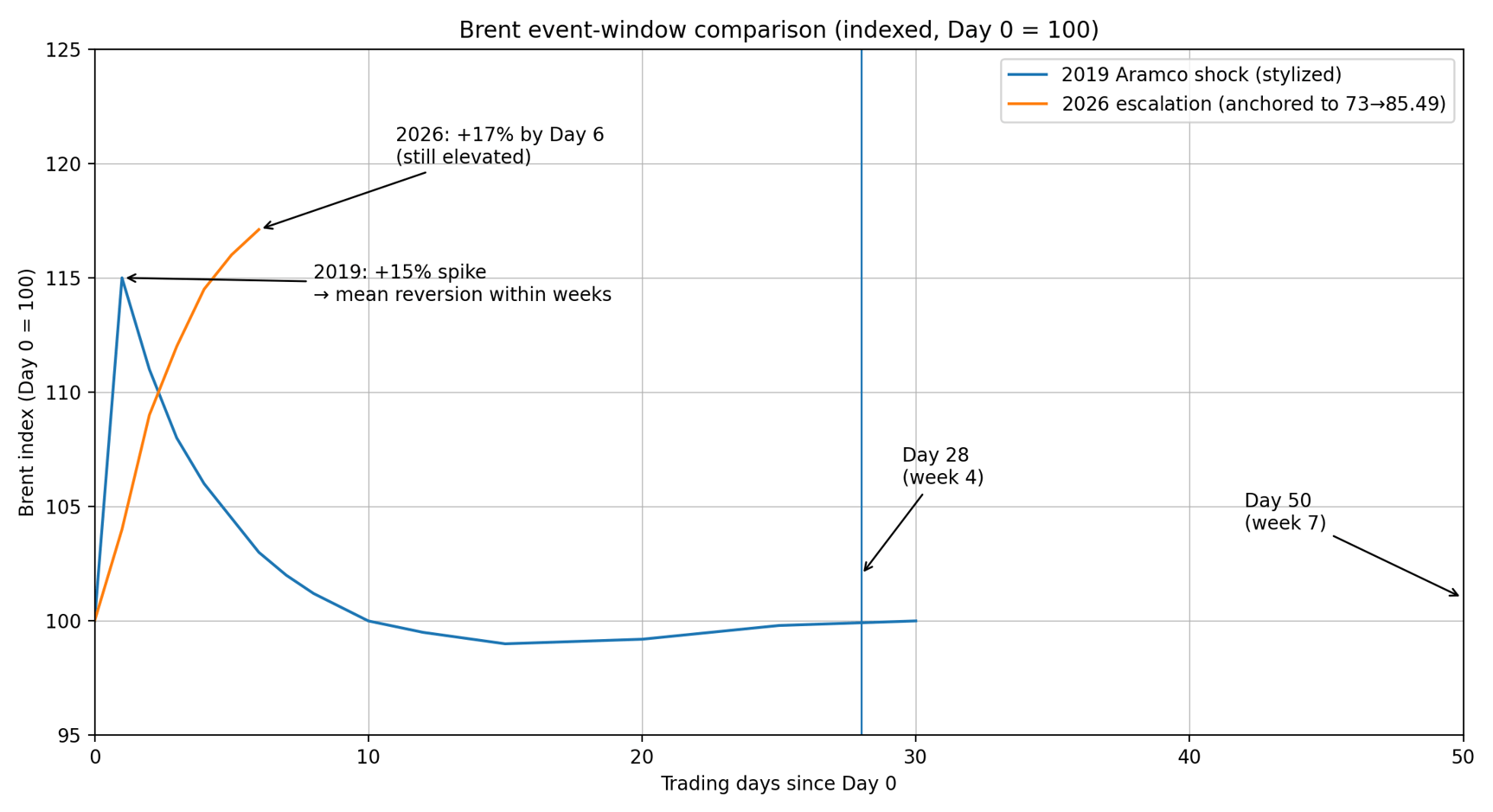

Oil shock could send Bitcoin down 45% if price surge forces Fed to delay cuts

President Donald Trump projected four to five weeks for the conflict with Iran to come to an end. The market priced its playbook: headline shock, brief spike, diplomatic theater, then normalization. That script worked in 2019 when drones hit Saudi Aramco

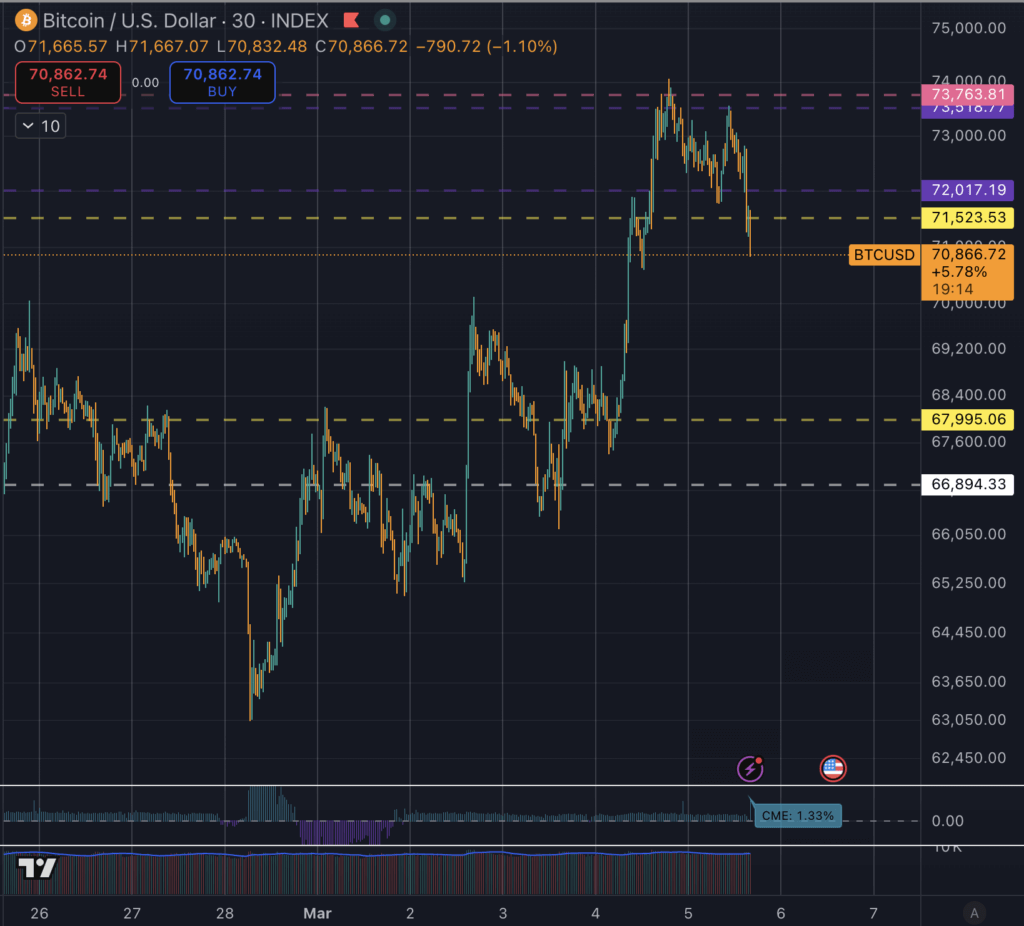

Bitcoin could tag $90,000 again but only if this level stops acting like a sell wall for trapped traders

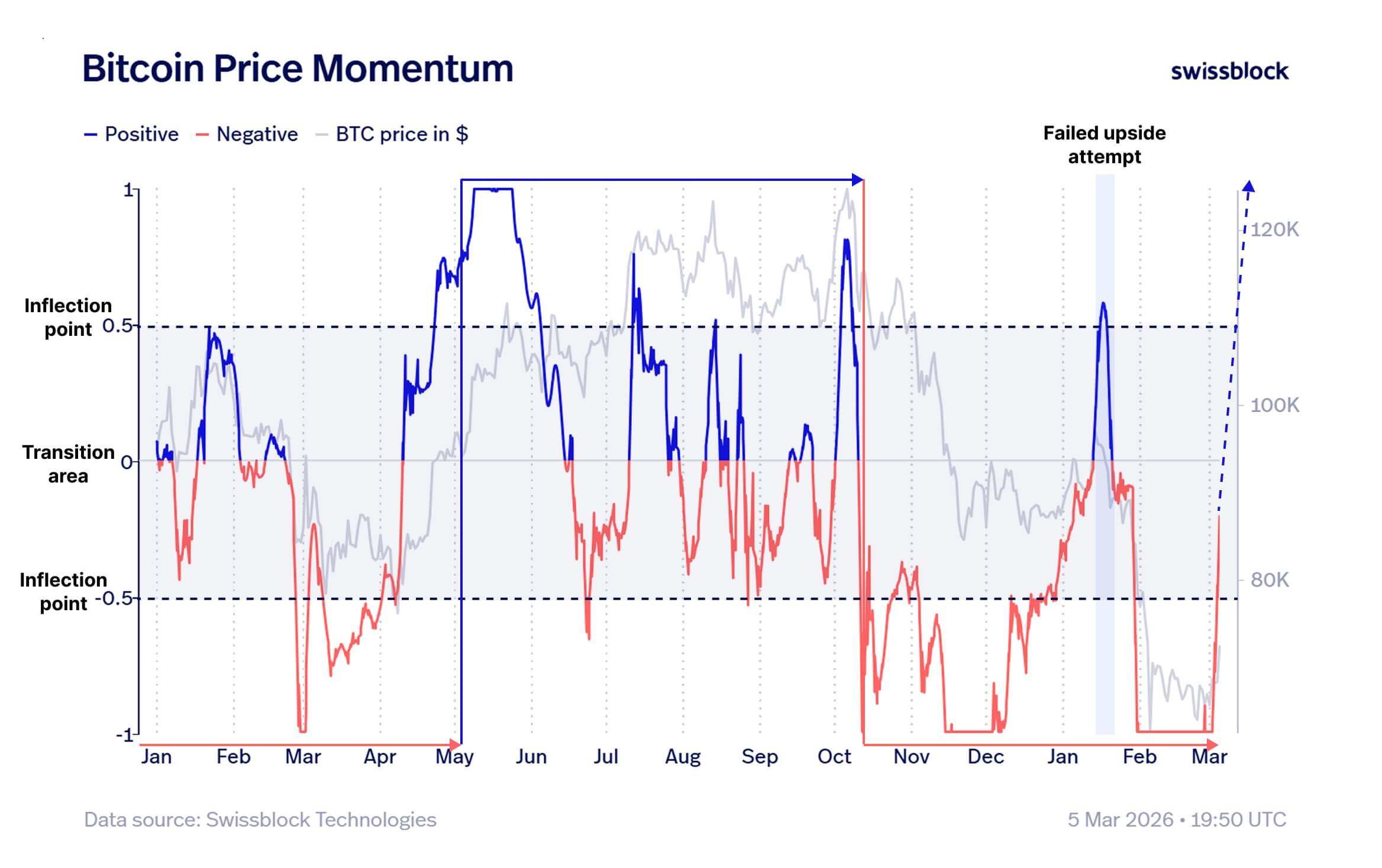

Bitcoin’s brief rally above $73,000 during the past day has the feel of a price performance that could still fade, fast, noisy, and familiar to anyone who has watched bear-market rebounds fail. What is different this time is not the price

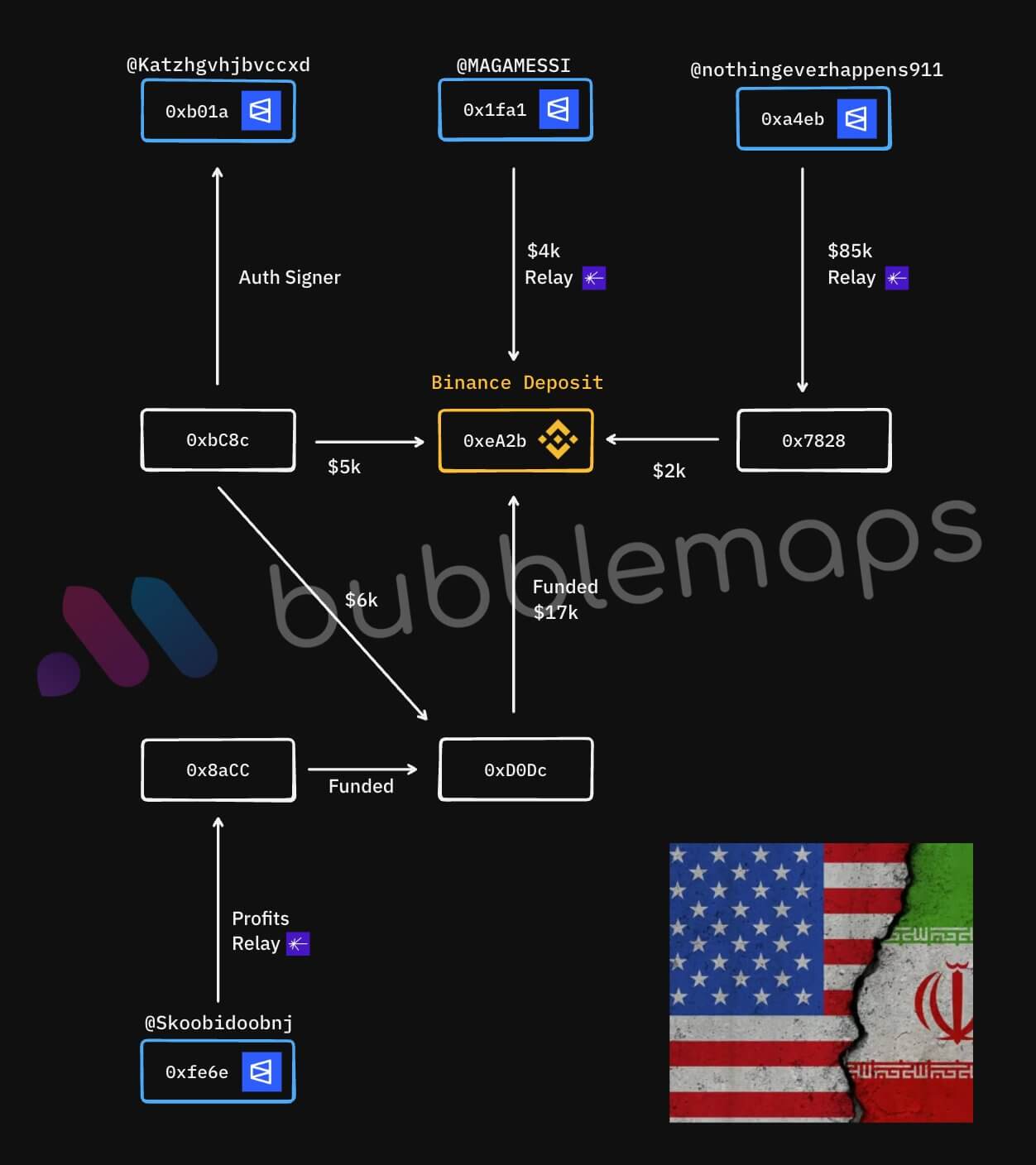

After $679 million in Iran war bets, Democrats move to ban prediction markets tied to military action

Washington lawmakers are moving on multiple fronts to curb the most politically toxic corners of prediction markets after millions of dollars flowed into bets tied to US-linked military action in Iran. Over the past week, several Democratic lawmakers have been pursuing

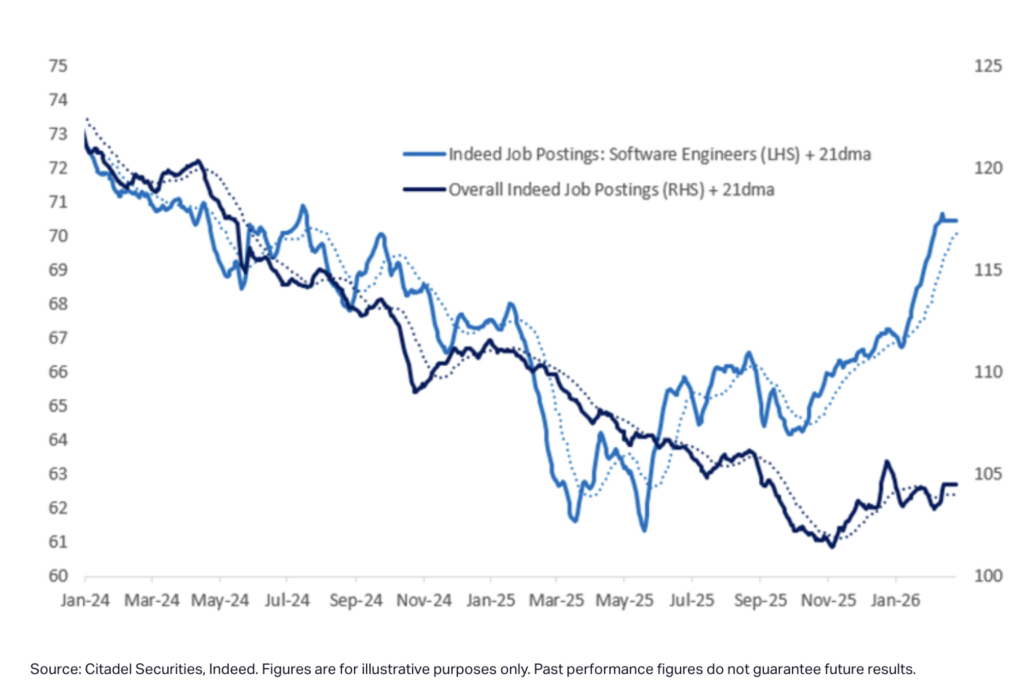

AI is boosting demand for high skill tech jobs while quietly killing entry-level roles

AI is raising demand for builders, not erasing them In February, a Citadel Securities analysis using Indeed data showed software-engineer job postings rising while overall job postings stayed weaker. That split does not mean AI is creating jobs across the whole economy.

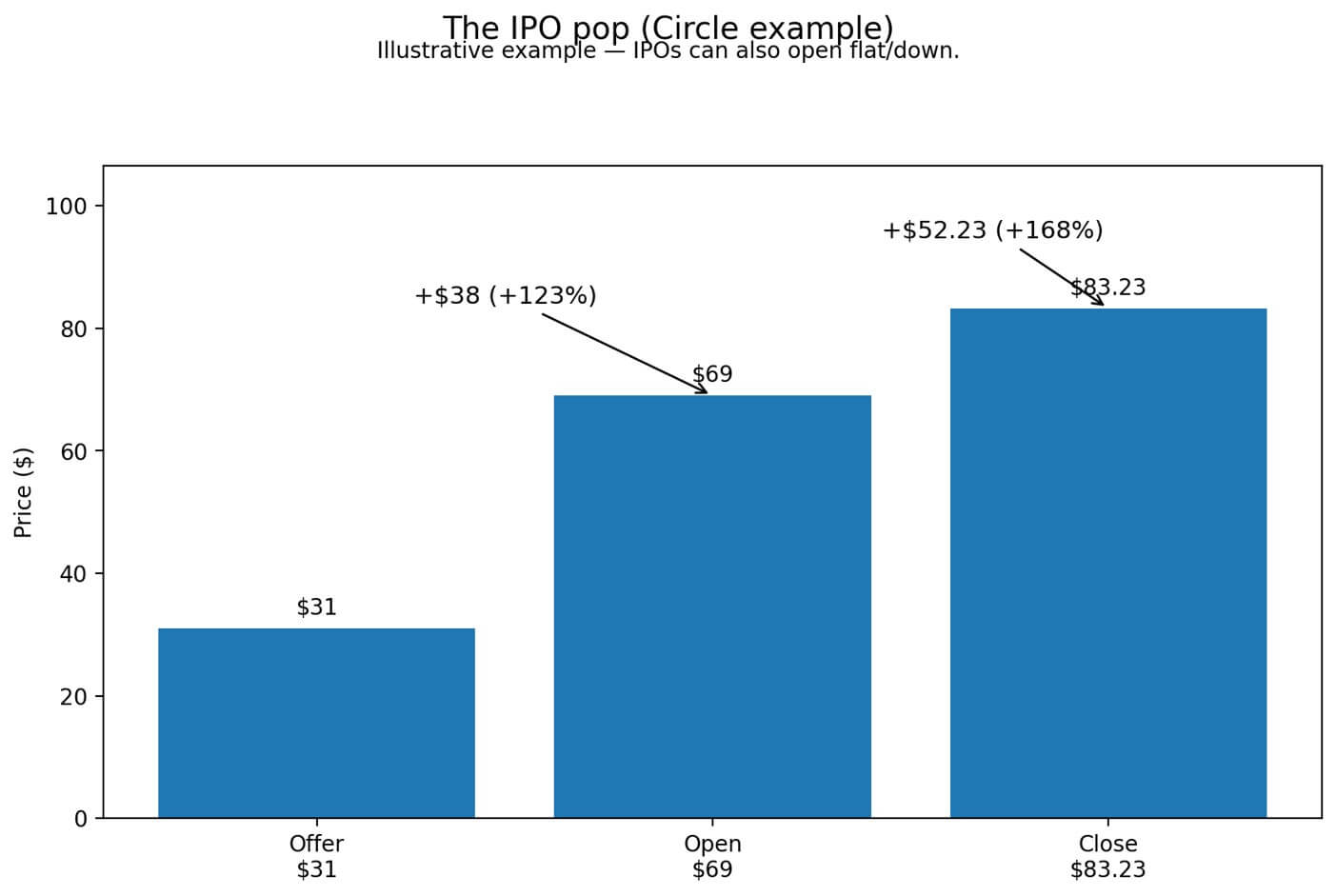

Crypto platform aims to let retail investors buy IPO shares at the same price as Wall Street insiders

Most people only see IPOs after the price resets at the open. Institutional investors and select clients receive allocations at the offering price, while everyone else waits for the exchange to start trading and buys at the market price. The gap

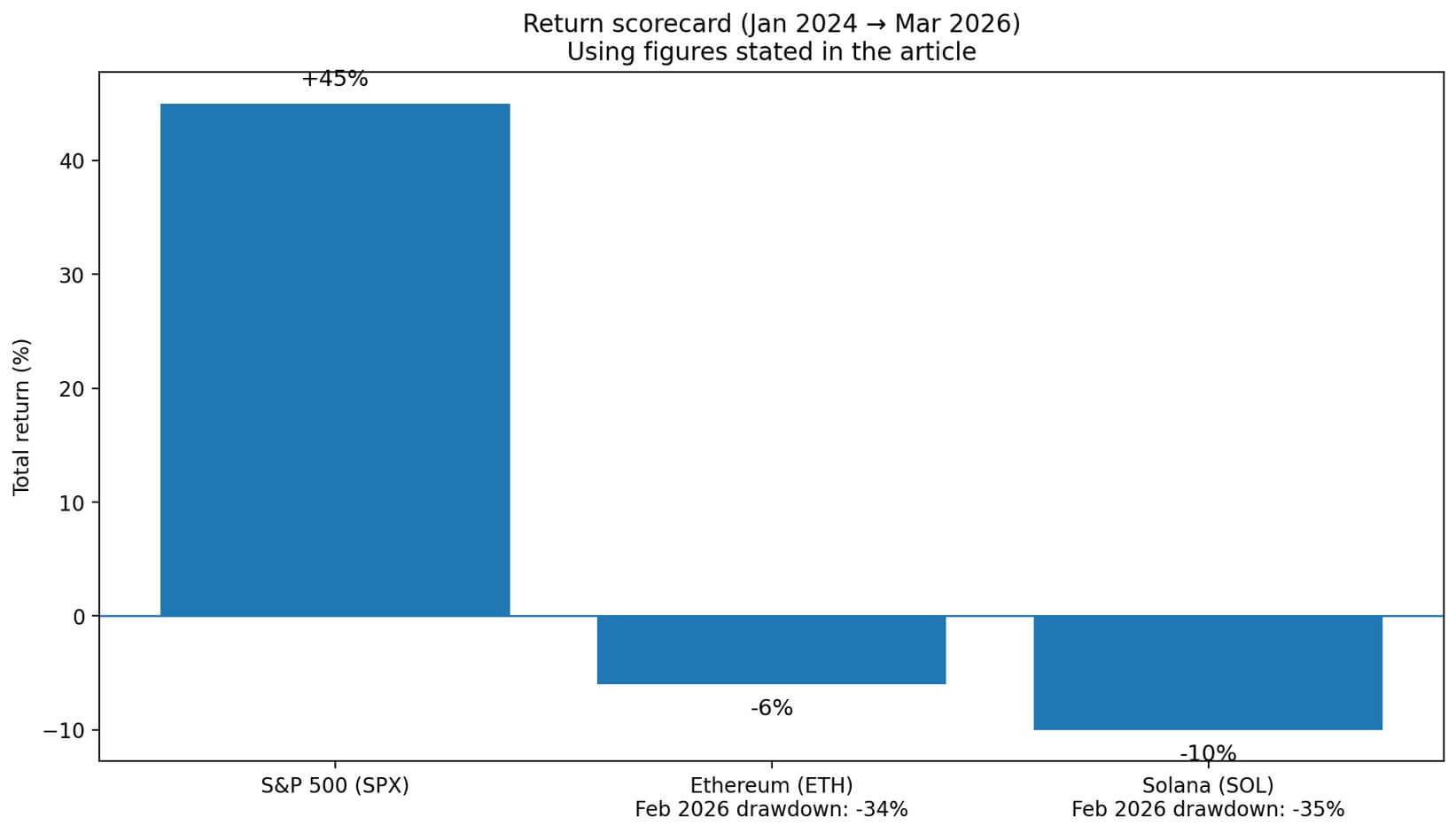

Bitcoin investors may not need altcoins to diversify if tokenized stocks move on-chain

Crypto promised diversification beyond Bitcoin. For years, the pitch was simple: spread risk across blockchains, decentralized applications, and layer-1 protocols. In practice, that diversification often collapsed when Bitcoin stumbled. Ethereum, Solana, and other major altcoins routinely fell harder than BTC during

Ripple quietly appears inside Wall Street’s stock-clearing system as it expands XRP payments platform

Ripple is sharpening its argument that it can help institutions move value across traditional rails, stablecoins, and blockchain networks. On March 2, DTCC’s National Securities Clearing Corporation updated its MPID directory to add Ripple-owned “Hidden Road Partners CIV US LLC” for

Israel’s Iran war will soon cost the equivalent of 41,300 Bitcoin every week

Israel’s Finance Ministry has put a weekly price tag on the country’s widening war with Iran, estimating that the economy could take a hit of more than 9 billion shekels (equivalent to $2.93 billion) a week if emergency limits on

Bitcoin fails again at $71,500 as weakening momentum raises risk of a deeper pullback

Bitcoin has again failed to hold $71,500, reinforcing the level as a long-term ceiling while global markets shift into a risk-off environment driven by rising oil prices and higher bond yields. The latest rejection came after Bitcoin briefly rose past $73,000,

Bitcoin jumps to $72,000 as Asia’s stock market meltdown deepens

The South Korean stock market (KOSPI) closed near 5,094 after falling 12.06% in a single session today. The index had already fallen 7.24% the prior session, taking the two-day slide to roughly 18.4% on a compounded basis. South Korean equities did

Tether finally lands a Big Four auditor – but the $189B USDT question still isn’t answered

Tether has landed a Big Four accounting firm’s name on a reserve report tied to its US strategy. On Feb. 27, Deloitte issued an independent accountant’s report on Anchorage Digital Bank’s “USAT Reserve Report,” an attestation covering USAT, a US dollar