Bitcoin price recovery dream meets $18.8 trillion household debt, and one Fed decision could flip everything

The US economy is starting 2026 with an uncomfortable split-screen scenario that is complicating the outlook for Bitcoin's recovery towards $100,000. While Wall Street credit pricing still looks calm, the “real economy” stress gauges are flashing late-cycle warning lights. This disconnect matters

Coinbase lost $667M but one boring custody detail decides whether crypto ETF holders should worry

Coinbase just posted the kind of earnings report that makes two groups of people sweat at the same time. The first group is obvious, COIN shareholders who saw the company swing into a loss while crypto prices and activity cooled. Coinbase

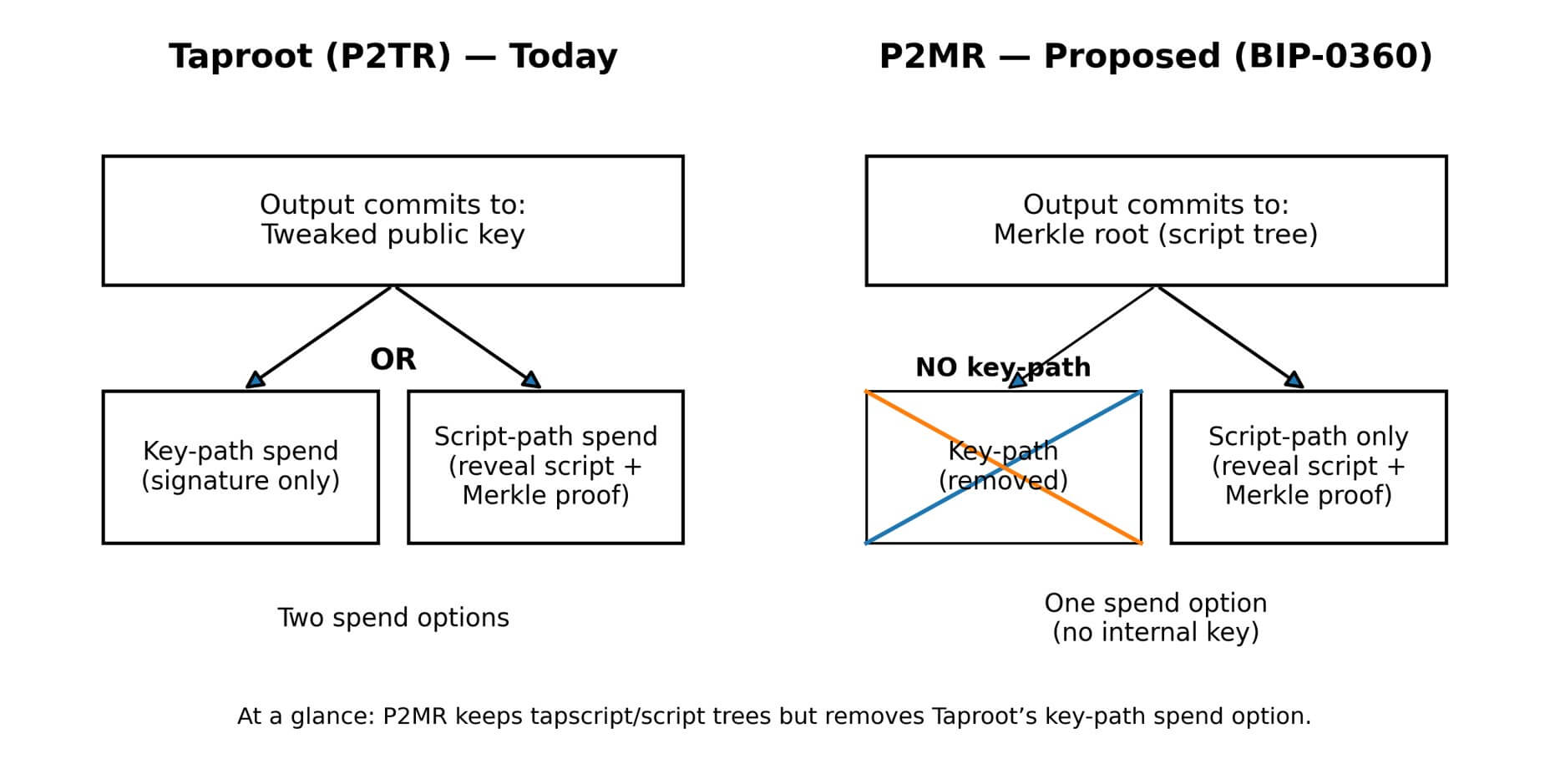

This “quantum-safe” Bitcoin idea removes Taproot’s key-path — and raises fees on purpose

Bitcoin developer contributors just cleared a documentation hurdle that crypto Twitter treated like an emergency quantum patch. It wasn't. On Feb. 11, a proposal for a new output type, Pay-to-Merkle-Root (BIP-0360), was merged into the official Bitcoin Improvement Proposals repository. No

CFTC chair just built a 35-seat crypto mega-panel, and it changes the SEC vs CFTC fight

CFTC Chair forms a new Innovation Advisory Committee packed with crypto, exchange, and prediction-market CEOs Most crypto traders barely think about the Commodity Futures Trading Commission until something breaks, a lawsuit hits, or a Bitcoin futures headline crosses their feed. In the

Bitcoin spikes 6% on softer US inflation but the CPI record still has holes after the shutdown

At 8:30 a.m. in New York, the world paused for the January U.S. inflation data, and it landed with a soft thud. Headline CPI printed +2.4% year over year, a shade under the +2.5% estimate that had been floating around ahead

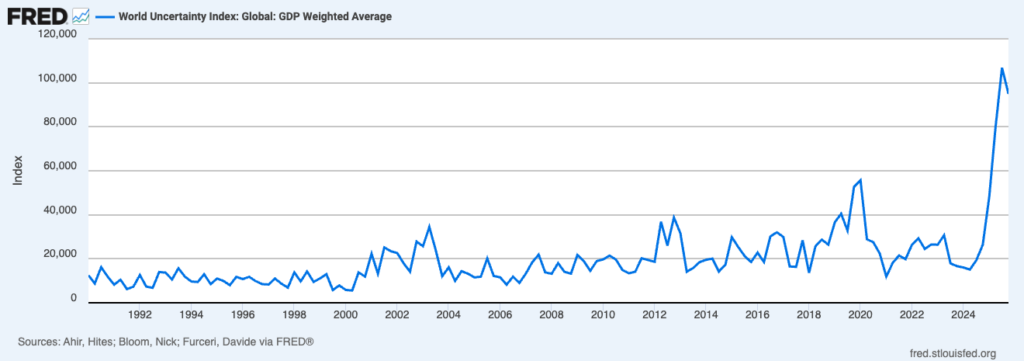

Can Bitcoin handle global economic uncertainty being worse than ever as it now doubles 2008 recession levels?

The World Uncertainty Index, a GDP-weighted measure constructed from the frequency with which “uncertainty” appears in Economist Intelligence Unit country reports, reached 106,862.2 in the third quarter of 2025 and remained elevated at 94,947.1 in the fourth quarter. WUI all-time record

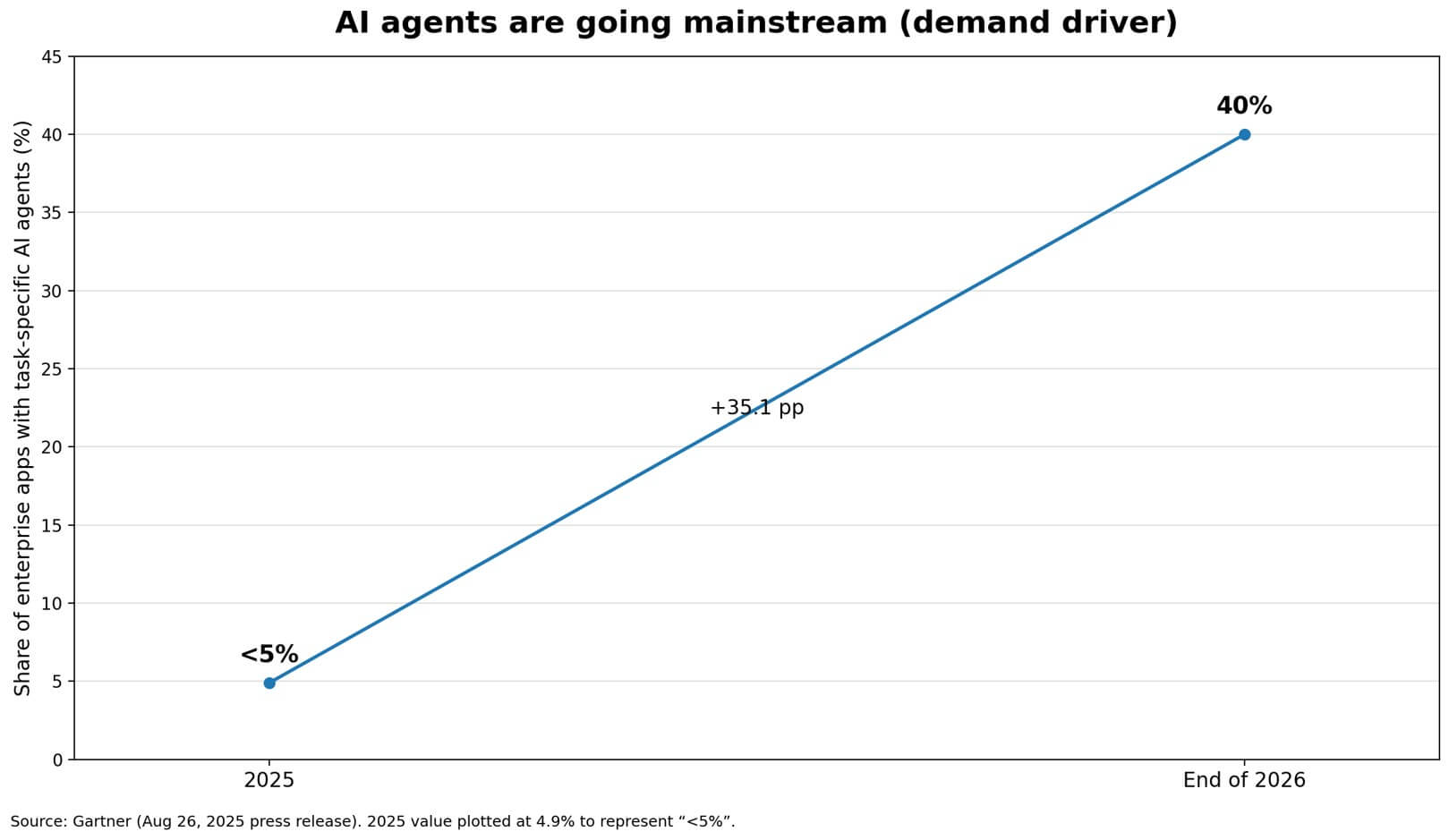

Vitalik Buterin pitches Ethereum as the AI settlement layer, but one hidden leak could ruin it

Vitalik Buterin just published a research proposal that sidesteps the question everyone keeps asking: can blockchains run AI models? Instead, the research claims Ethereum as the privacy-preserving settlement layer for metered AI and API usage. The post, co-authored with Davide Crapis

Ethereum price decline is testing Wall Street as ETF flows flip while a $1,800 retest looms

Ethereum's slide toward $2,000 has left its exchange-traded fund (ETF) investors holding more than $5 billion in paper losses, extending a marketwide crypto drawdown that has also hit Bitcoin. According to CryptoSlate's data, the move has tracked a broader risk-off wave

Bitcoin price looks to bottom out near $50,000 as recession fears retreat despite scary headlines

Bitcoin can bottom soon because a 2026 recession, or a stock market crash, keeps looking like the outlier scenario My core idea around the Bitcoin market has remained the same since last September, before we hit the all-time high in October.

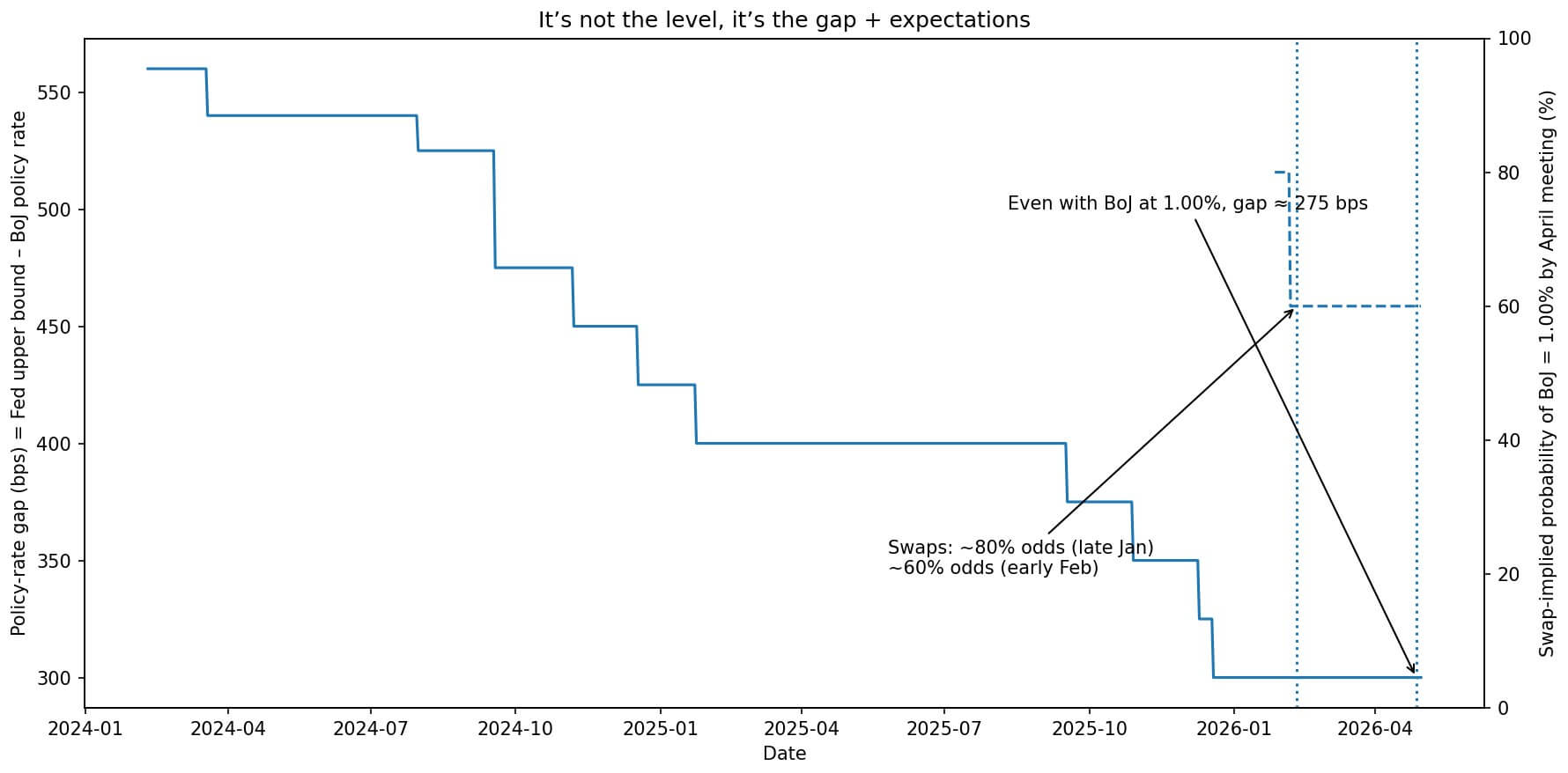

Odds Bank of Japan raises rates hits 80% with Bitcoin on the sideline – one hidden signal decides everything

Bank of America Securities expects the Bank of Japan (BoJ) to raise its policy rate from 0.75% to 1.0% at its April 27-28 meeting. Markets already price roughly 80% odds of that outcome, according to swap data cited in recent

Bitcoin price is sliding today because the government admitted nearly 1 million jobs from last year never existed

At 8:30 a.m. Eastern, the U.S. labor market handed traders a breaking story with two timelines, one for today, one for last year. Nonfarm payrolls grew by 130,000 in January, unemployment held at 4.3%, and wages kept climbing. The details came straight

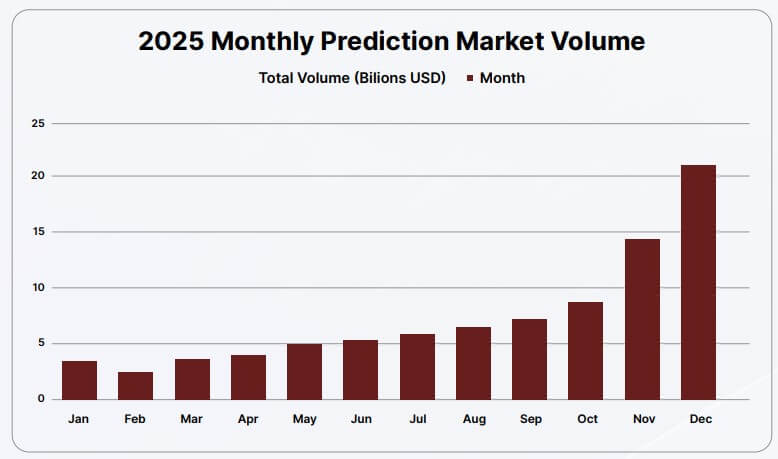

Prediction markets hit $64 billion in 2025 but reliance on centralized logins has created a critical security flaw

Prediction markets entered the mainstream in 2025, with a fourfold surge in annual trading volume as a handful of venues consolidated control over what is rapidly becoming an institutional-scale product, according to a new report from blockchain security firm CertiK. The

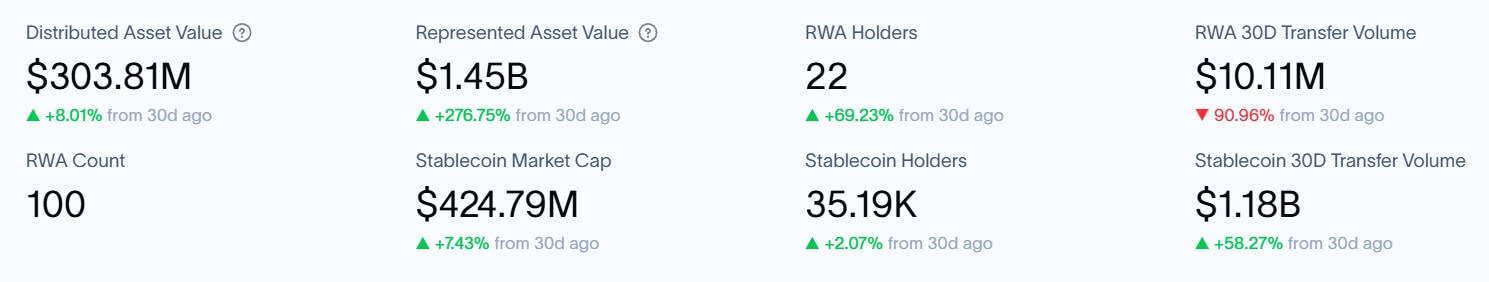

XRP Ledger just flipped Solana in RWA tokenization value and the holder count reveals why

The XRP Ledger (XRPL) has overtaken Solana on one closely watched metric over the past month, flipping it in real-world asset tokenization, excluding stablecoins. Data from RWA.xyz indicate that the Ledger has approximately $1.756 billion in total on-chain real-world asset value,

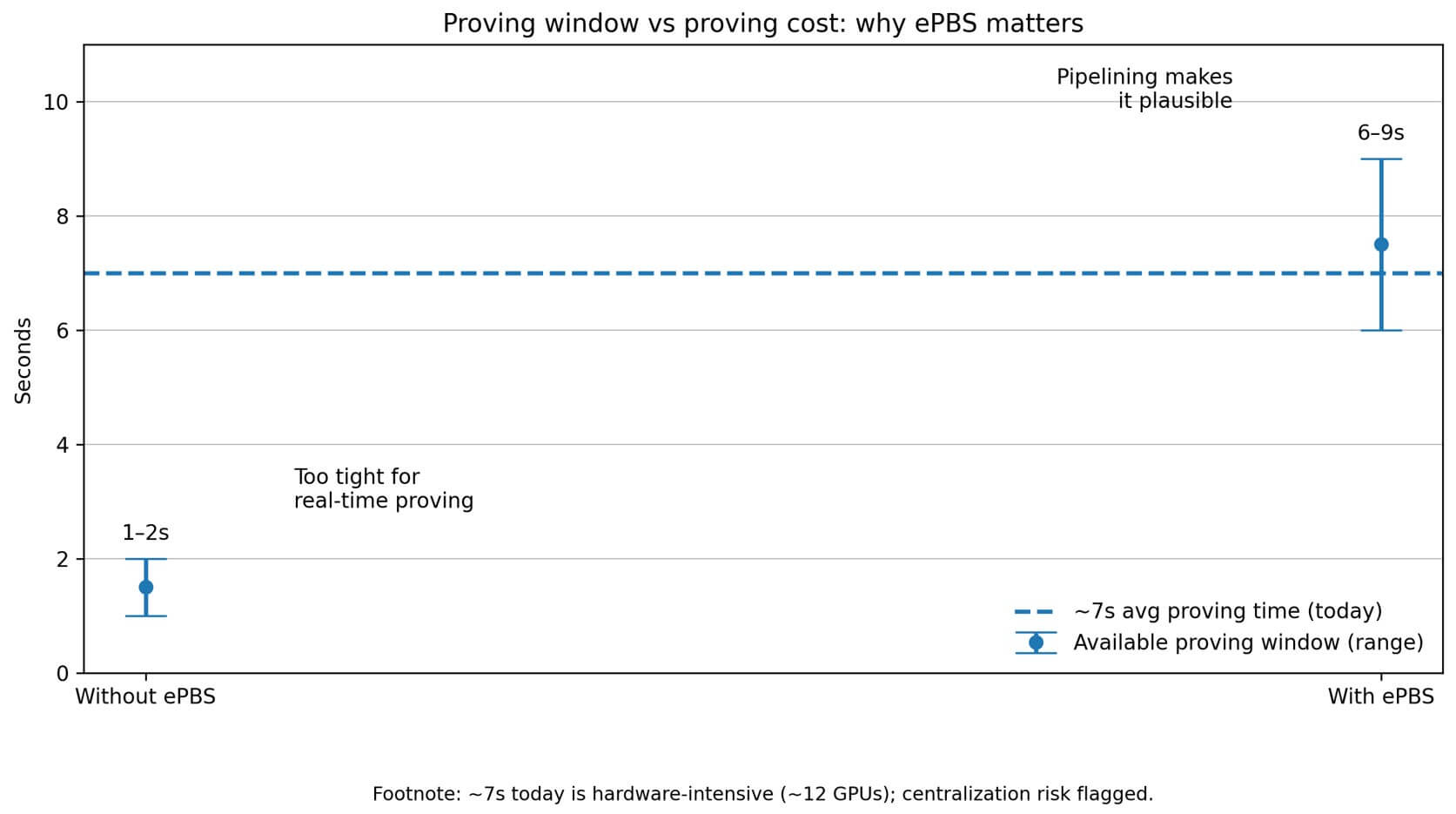

Ethereum wants home validators to verify proofs but a 12 GPU reality raises a new threat

Ethereum researcher ladislaus.eth published a walkthrough last week explaining how Ethereum plans to move from re-executing every transaction to verifying zero-knowledge proofs. The post frames it as a “quiet but fundamental transformation,” and the framing is accurate. Not because the work

Bitcoin whales just moved $4.7B dollars into cold storage while regular investors are busy panic selling the dip

Bitcoin’s sharp selloff last week appears to have triggered one of the largest buy-the-dip episodes of this market cycle. Data tracking accumulator addresses showed a record surge of coins moving into wallets associated with long-term holding behavior, even as flows through

Why Bitcoin ETFs bleed billions while Gold makes 53 new all-time highs with $559B in demand

Gold demand reached a record $555 billion in 2025, driven by an 84% surge in investment flows and $89 billion in inflows into physically backed ETFs. The World Gold Council reports ETF holdings climbed 801 tons to an all-time high of

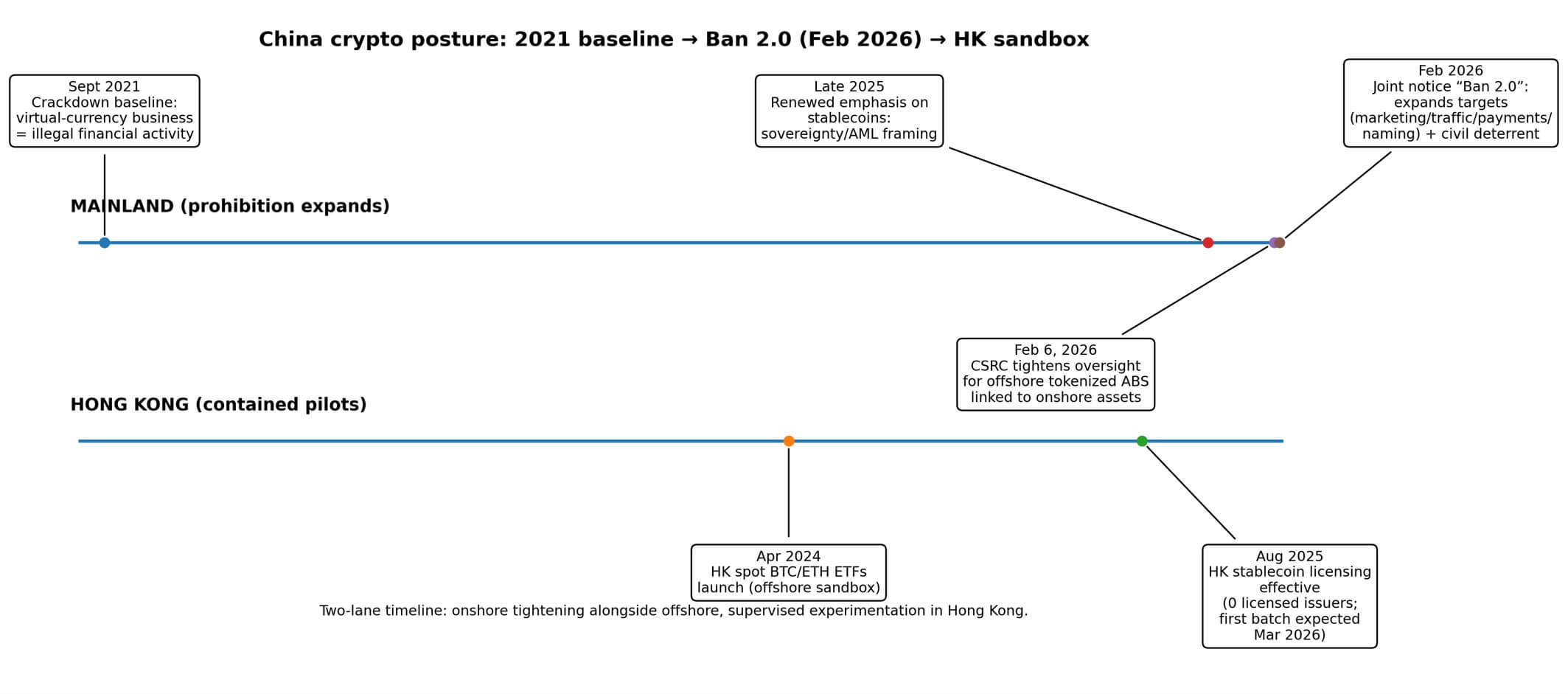

China Bitcoin legalization is priced at 5% but Beijing’s February 2026 Ban 2.0 made one detail brutal

Polymarket traders are pricing the prospect of China legalizing onshore Bitcoin purchases at roughly 5%. At first glance, the number appears dismissive. Still, it raises the question of whether the Chinese government will explicitly permit citizens to convert renminbi into Bitcoin

White House meeting could unfreeze the crypto CLARITY Act this week, but crypto rewards likely to be the price

White House stablecoin meeting could unfreeze the CLARITY Act, but your USDC rewards may be the price The newly confirmed Feb. 10 White House meeting on stablecoin policy is being framed by some market observers as a step toward breaking the