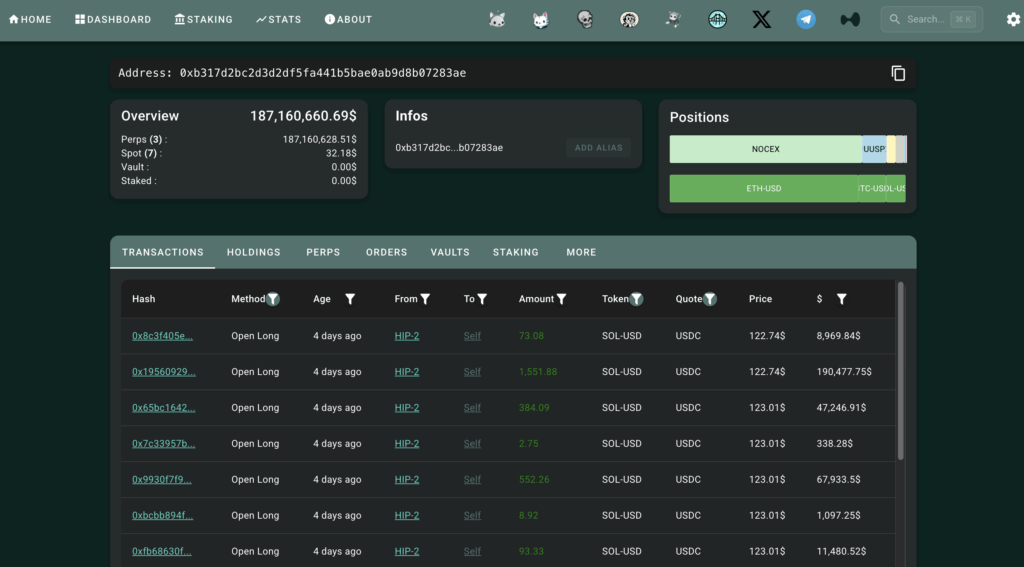

This legendary $197M bear has flipped long altcoins with high leverage, but funding rates signal a dangerous trap

There are traders you hear about because they talk, and traders you hear about because their footprints keep showing up in public data. The wallet that crypto Twitter has been calling “BitcoinOG,” “1011short,” or some variation of those names falls into

Bitmain just slashed mining rig prices, proving the market’s oldest “Bitcoin rule” is officially dead

Bitmain cut prices on Bitcoin mining rigs on Dec. 23 after miner revenue per unit of hashrate fell in November. The discounts, which extend to current-generation hydro and immersion products, are landing in a cycle in which Bitcoin’s price strength has

Bitcoin just lost $90,000, and a quiet surge in energy markets suggests the pain isn’t over

Bitcoin traded near $86,800 on Monday morning after reversing its Sunday move above $90,000, as crude oil rose and gold fell.

Bitcoin analyst warns of “biggest financial mistake of the decade” for those still using this common theory

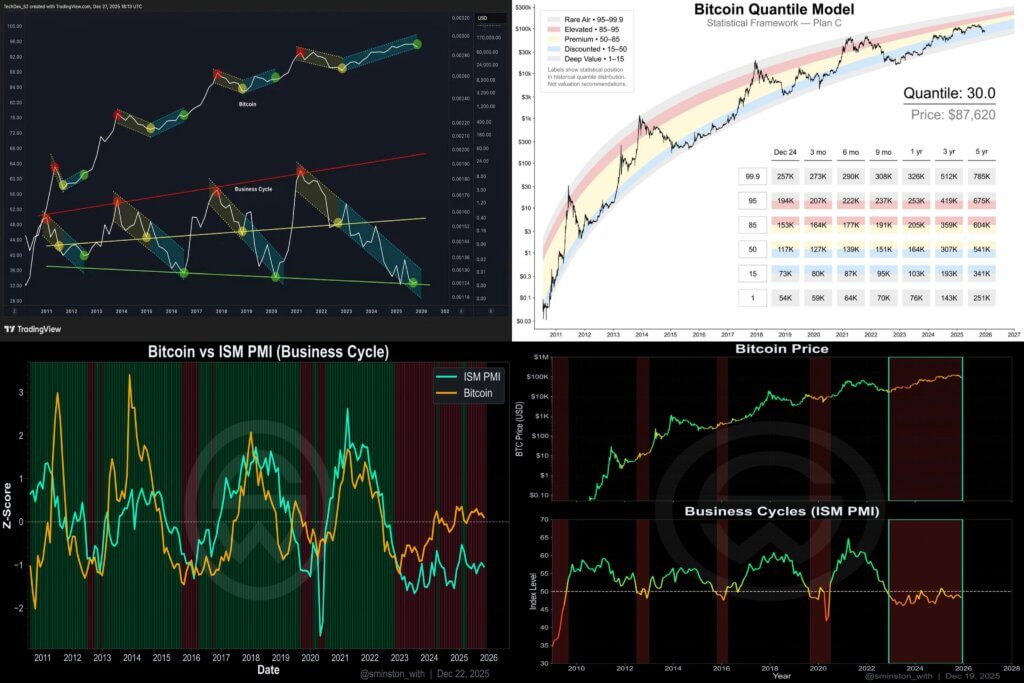

Analyst and creator of the ‘Bitcoin Quantile Model,' Plan C, just posted a bundle of charts that pushed back on the idea of repeating cycle playbooks as Bitcoin trades around $87,661. The set frames a macro mix where business-cycle gauges remain

XRP is quietly forming a “spring-loaded” supply setup that frustrated retail traders are completely ignoring

XRP is ending 2025 with one of the most paradoxical profiles in the crypto market, thanks to record-breaking institutional inflows colliding with one of the weakest price charts.

Ethereum’s 2026 roadmap includes this validator risk that’s bigger than you think

Ethereum’s 2026 roadmap centers on two tracks: expanding rollup data capacity through blobs while pushing base-layer execution higher through gas limit changes. Those gas limit changes depend on validators moving from re-executing blocks to verifying ZK execution proofs. The first track is

Coinbase claims arrest in the $355 million insider extortion scheme that targeted nearly 70,000 customers

Coinbase said a former customer support agent was arrested in India as investigators probe a breach tied to insider bribery and customer data theft. Chief Executive Officer Brian Armstrong said on Dec. 27 that the arrest involved a former support agent

Bitcoin has 70% chance of a massive 2026 breakout, but only if this trend holds

On a cold ‘Betwixmas' December morning, the mood around Bitcoin feels familiar and strange at the same time. Familiar, because the story still swings between euphoria and anxiety. Strange, because the people watching the chart now include a different crowd.

Bitcoin ETF “record outflows” are deceptive as crypto products absorbed $46.7 billion in 2025

Bitcoin ETF headlines have turned into a scoreboard with “record inflows,” “largest outflows ever,” and “institutions dumping.” The problem is that most stories isolate a single day or a single fund. Without context on cumulative flows, fund cohorts, and custody plumbing,

How browser extensions expose crypto to a fatal design flaw the industry ignored, bleeding $713M in 2025

Trust Wallet's Chrome extension shipped a malicious update in December, exfiltrating wallet data and draining roughly $7 million from hundreds of accounts before the company pushed a fix. The compromised version 2.68 was live for days, auto-updating in the background, the

We mapped every major 2025 crypto regulation change to show you which rules actually protect your wallet

In 2025, crypto regulation stopped being mostly about courtroom theater and started focusing on actual infrastructure. Debates over how or whether to regulate crypto became less philosophical and more operational. Regulators spent the year answering the “boring” questions that decide whether

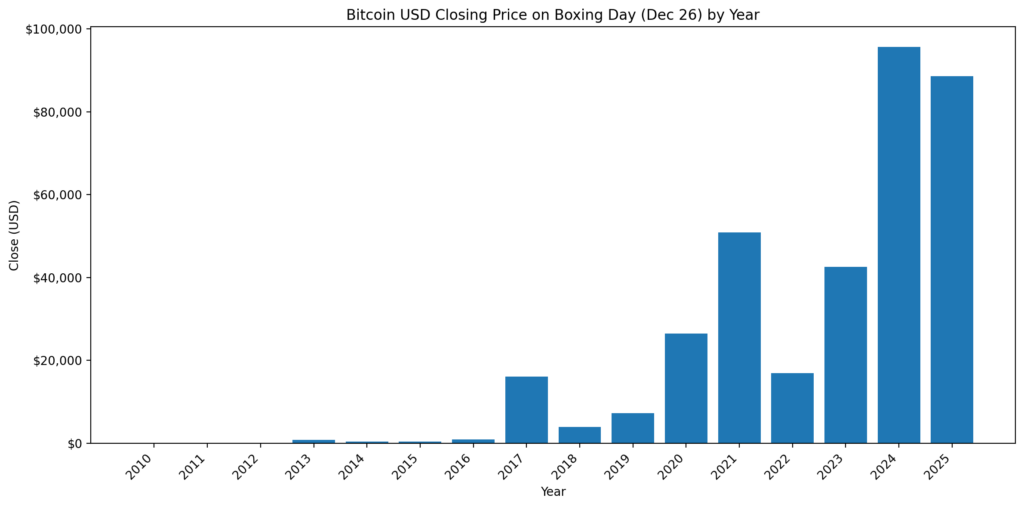

Bitcoin just missed its $95k Boxing Day record, triggering signal that demands immediate attention

Every Boxing Day, I make the same cup of tea, check the same price chart, and ask the same question: What story is Bitcoin telling this year? Line up the December 26 close from the start of the exchange era to

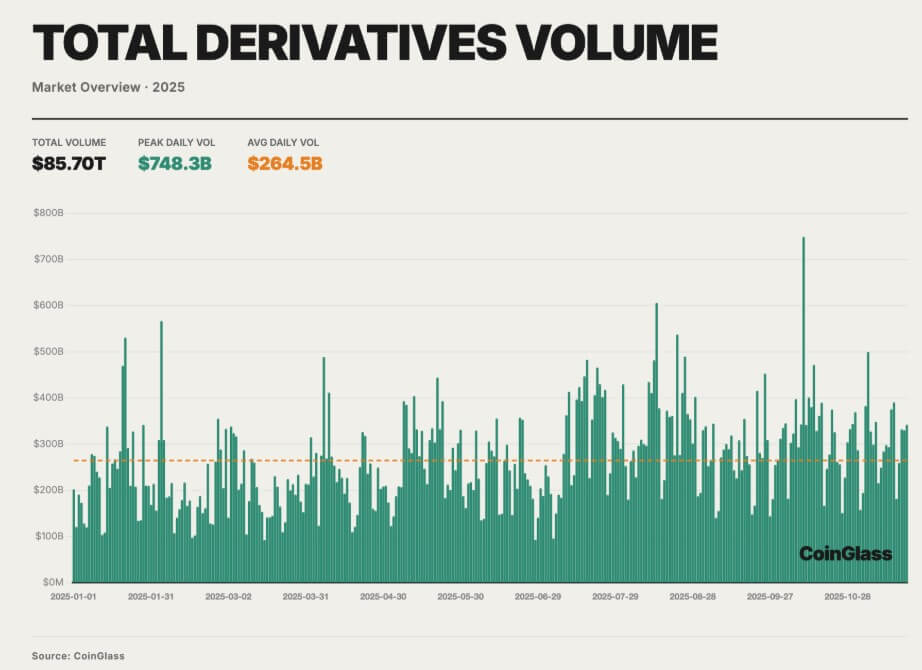

How $150 billion was liquidated from crypto market in 2025 driving Bitcoin crash

Forced liquidations in the crypto derivatives market reached about $150 billion in 2025, according to CoinGlass data. On its face, the figure looks like a year of persistent crisis. For many retail traders, watching price feeds turn red became shorthand for

Bitcoin models show a 70% chance of a massive 2026 breakout, but only if this trend holds

On a cold ‘Betwixmas' December morning, the mood around Bitcoin feels familiar and strange at the same time. Familiar, because the story still swings between euphoria and anxiety. Strange, because the people watching the chart now include a different crowd.

10 stories that rewired digital finance in 2025 – the year crypto became infrastructure

This year opened with Bitcoin (BTC) proponents expecting a clean rally, driven by halving narratives, spot ETF momentum, and a Fed pivot all stacked neatly in their favor. Instead, the year closed with BTC stuck 30% below its October peak, North

Crypto sentiment is trapped in extreme fear because the industry’s biggest structural wins are failing to move prices

Crypto sentiment gauges have spent the past two months deep in the red. The Crypto Fear & Greed Index has spent more than 30% of 2025 in fear or extreme fear territory, and alternative trackers put the market in a

The memecoin hall of shame: 10 tokens that defined 2025 wildest trades

The year opened with a sitting president launching his own token three days before inauguration and closed with researchers proving that one of the year's “comeback stories” was controlled by a few dozen wallets. Between those bookends, 2025 turned memecoins from

The Bitcoin “hard asset” narrative is breaking as silver hits parabolic peaks without taking crypto along for the ride

Silver left the $50 range in late November and went parabolic into year-end, registering consecutive all-time highs and hitting $72 an ounce on Dec. 24. Gold made a similar run throughout 2025, reaching $4,524.30 the same day. Bitcoin, however, traded at