New prison report flouts claim FTX could have repaid customers from $25B in assets

Sam Bankman-Fried is again challenging the core narrative of his downfall: that FTX was insolvent when it collapsed in November 2022.

In a 15-page report written from prison and dated Sept. 30, the convicted founder claimed the exchange “was never insolvent” but merely trapped in a “liquidity crisis” after customers pulled $5 billion in two days.

He argued that FTX and its trading arm, Alameda Research, together held $25 billion in assets and $16 billion in equity value against about $13 billion in liabilities. According to him, his firms had enough to repay customers in full if the company had been allowed to continue operating.

He wrote:

“FTX always had sufficient assets to repay all customers, in kind, and provide significant value to equity holders as well. That is what would have happened if lawyers hadn’t taken over FTX.”

Instead, Bankman-Fried blames outside counsel and new CEO John J. Ray III for pushing FTX into Chapter 11 before rescue financing could be completed.

His framing of FTX’s issue as a liquidity problem, rather than insolvency, serves to soften allegations of fraud and redirects blame toward the legal team that froze operations.

If accepted, it transforms the implosion from one of misused deposits into a fixable bank run cut short by overzealous lawyers.

Solvency by hindsight

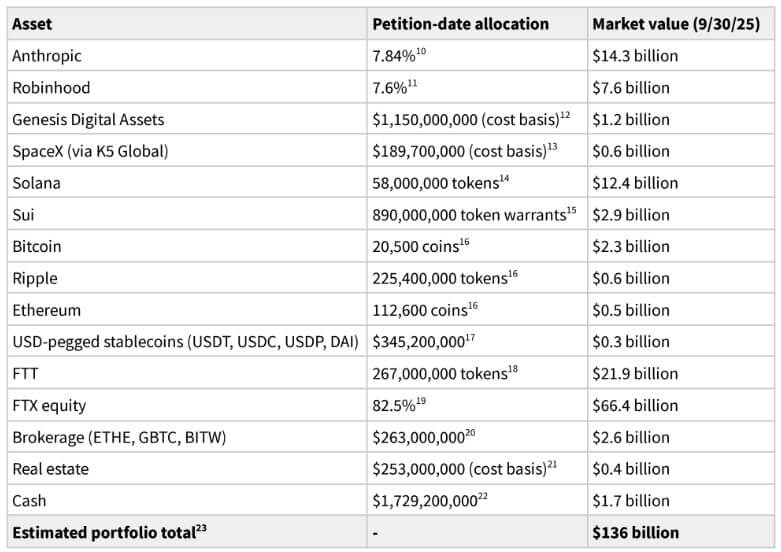

In his report, Bankman-Fried treats FTX’s frozen portfolio as if it had survived intact through the entire 2023–25 market recovery.

He reprices the bankrupt firm’s holdings in Solana, Robinhood, Sui, Anthropic, and even the now-worthless FTT token at current values, suggesting that by the end of this year, the basket would be worth roughly $136 billion. This would easily cover the $25 billion he cites in customer and creditor claims.

From there, he insists, everyone could have been paid “in full, in kind,” and equity investors would still have walked away with billions.

However, that reasoning is flawed as it is “solvency by bull market.”

Bankruptcy law doesn’t allow a failed company to keep trading for years in the hope that rising prices will repair its balance sheet. Once Chapter 11 is filed, claims are frozen at the petition date, converted to dollars, and pursued through recovery, not speculation.

As former FTX general counsel Ryne Miller pointed out:

“That week in November 2022, assets on hand were nothing near adequate, and the founders were fabricating asset lists (and desperately chasing new investors). The coins were gone, folks. Your coins were gone. That’s why bankruptcy happened.”

This means that much of FTX’s portfolio was built with commingled customer funds. No court would have permitted those assets to remain at risk while management gambled on a rebound.

Bankman-Fried’s math only works if regulators and creditors had let an exchange under criminal and liquidity stress keep operating normally for two more years, a scenario that borders on fantasy.

The FTX reboot that never happened

The same optimism underlies his claim that FTX was “shut down too early.”

Bankman-Fried insists the exchange was still earning about $3 million a day and nearly $1 billion a year when Ray halted operations. He also maintains that management had identified $6 billion to $8 billion in emergency financing that could have closed the hole “by the end of November 2022.”

That line of argument assumes FTX remained a going concern, that trading would have continued, customers would have stayed, and the venture portfolio could have avoided fire-sale discounts.

But by mid-November, the exchange faced a complete collapse of confidence. Counterparties were fleeing, licenses were suspended, and law enforcement agencies were circling. Under those conditions, keeping FTX live would have risked deeper losses and regulatory backlash.

However, industry experts noted that the bankruptcy estate chose the safer route of freezing accounts, preserving what remained, and pursuing orderly asset recovery under court supervision.

In fact, Miller suggested that the bankruptcy estate’s decision helped salvage some value, rather than destroying it.

According to him, the estate’s disciplined management of FTX’s Solana and Anthropic stakes, both of which appreciated sharply in the recovery, became one of the main reasons creditors may now be made whole.

This means that Bankman-Fried’s portrait of a profitable firm unfairly shuttered by lawyers overlooks those realities. His assumptions about ongoing revenue and investor confidence belong to a world that no longer exists once trust evaporates.

Competing timelines, competing truths

At its core, the dispute centers on which timeline defines the company’s reality.

Bankman-Fried measures solvency by 2025 asset prices and a business that never closed. The bankruptcy estate measures it by what remained in November 2022.

On the estate’s timeline, FTX faced an $8 billion hole, assets were illiquid or overstated, and fresh funding efforts had stalled. Freezing operations and converting claims to dollars were the only fair course.

On Bankman-Fried’s timeline, the act of intervention caused the damage as lawyers “commandeered” the company, sold assets into a rising market, incurred nearly $1 billion in fees, and “destroyed” over $120 billion in hypothetical upside.

That inversion turns the cleanup into the culprit. It reframes a standard court-supervised wind-down as a hostile takeover that allegedly vaporized future value.

Yet the central fact remains unchanged: when customers demanded their money, FTX was unable to pay. Everything else is retroactive storytelling.

As blockchain investigator ZachXBT frames it:

“SBF is just trying to weaponize the fact that every FTX asset / investment has gone up from picobottom Nov 2022 prices when they factually could not pay out users at the time of bankruptcy and instead point the bankruptcy team as the true villain.”

The post New prison report flouts claim FTX could have repaid customers from $25B in assets appeared first on CryptoSlate.